Dollar

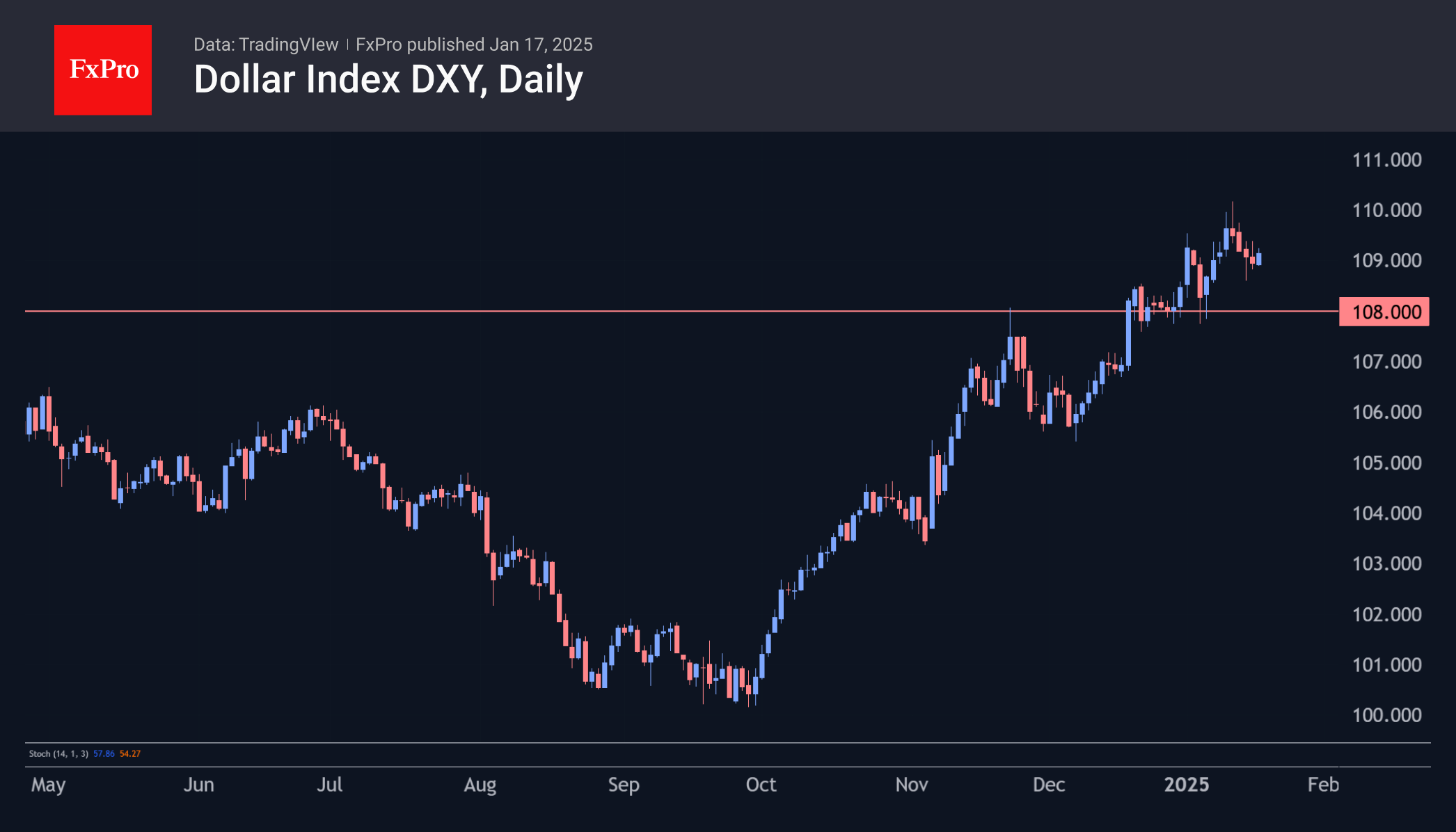

The dollar started the week touching the 110 level on the DXY, hitting more than two-year highs but was under pressure for most of the week. The dollar peaked when markets were experiencing their most hawkish expectations for the key rate, with a 32% chance being priced in that the rate would not be cut before the end of the year. Now the probability of that outcome has been decreased to 14%, taking 0.7% away from the dollar index.

The dollar bulls have nothing to fear for now. Their dominance is clearly visible on the chart in the form of a flat growth trend since the beginning of October last year, which is replaced by relatively short-lived corrections. Technically, we will be able to talk about the breaking of the upward trend only when DXY falls below 108, and now it is at 109.

So far, the fundamentals are in favour of the dollar, as the Fed’s main competitors are expected to cut their rates two to four times this year, while America can do with one. Meanwhile, the key rate is much higher, which also feeds interest in dollar-denominated assets versus those denominated in euros, pounds, yen and Canadian dollars.

US Indices

US indices appear to have reached their inflection point at the start of the week. It now looks as if the markets have completed their corrective pullback on January 13, returning to growth. This comeback has been fuelled by softer inflation numbers that have reduced fears that price increases are once again spiralling out of control.

The S&P500 stalled in early December due to fears of a strong labour market and then subsequently went down. However, a strong economy is not such bad news for the markets, so there was hardly anything more than a correction on the agenda. And it appears to have come to an end when investors concluded that inflation is not yet accelerating.

The FxPro Analyst Team