Weak macro data in early August triggered a simultaneous sell-off in equities and the dollar on fears of an economic meltdown. Over the past ten days, however, several important statistical releases have changed expectations.

Thursday’s retail sales and weekly jobless claims figures triggered a simultaneous rise in the dollar and equities, a rare and volatile phenomenon in US markets.

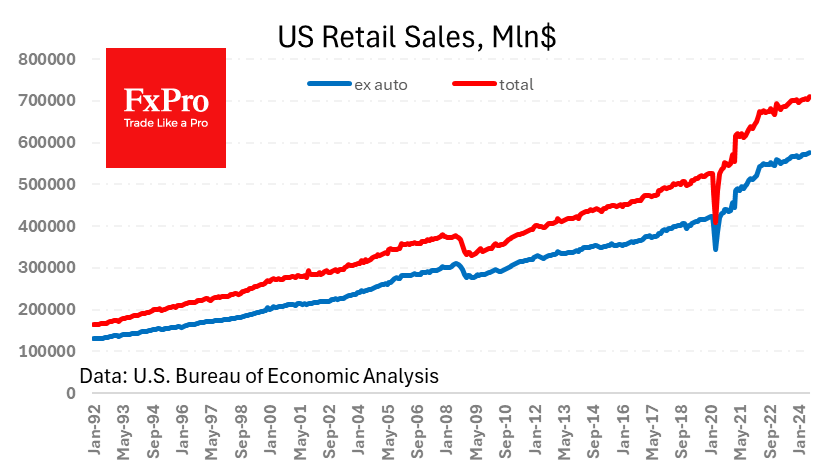

Retail sales rose 1% in July, a decisive step higher after three months of fluctuating around 0.2%. Excluding autos, sales rose 0.4%, after gains of 0.8% and 0.3% in the previous two months. The nominal year-on-year increase of 2.8% does not cover inflation (2.9%), but it is not yet a nominal contraction as in the recessions of 2008 and 2020.

The weekly jobless claims data continues to be positive. Initial claims fell by 7k after falling by 16k to 227k, the lowest level in five weeks. Almost exactly a year ago, there was a similar spike in claims, but it did not lead to a sustained rise in the number, and the labour market has been surprisingly strong for many months.

The dollar has rallied on the back of these reports as markets revise expectations for the pace of interest rate cuts in the coming months. This move may be an attempt by the dollar to reverse the downtrend that has been in place since April and accelerated in August.

The positive reaction of stock indices in the short term is understandable, as it calms fears of a recession. In the longer term, however, higher bond yields will limit the buying of equities.

The FxPro Analyst Team