The US Dollar has gone on the counterattack thanks to the Fed’s reluctance to cut rates and support from the White House. The US and China are preparing for trade talks, and Donald Trump is announcing a deal with the UK. Rumours are circulating in the market that the President will loosen Joe Biden’s restrictions on trade in artificial intelligence chips. This allows the S&P 500 and the USD index to spread their wings.

Jerome Powell argues that the US economy is strong, which gives the Fed time to keep rates in the 4.25%- 4.5% range. The central bank is worried about inflation accelerating due to the rates, while its counterparts from other countries fear slowing economic growth. They intend to cut rates, and the divergence in monetary policy plays into the hands of the US dollar.

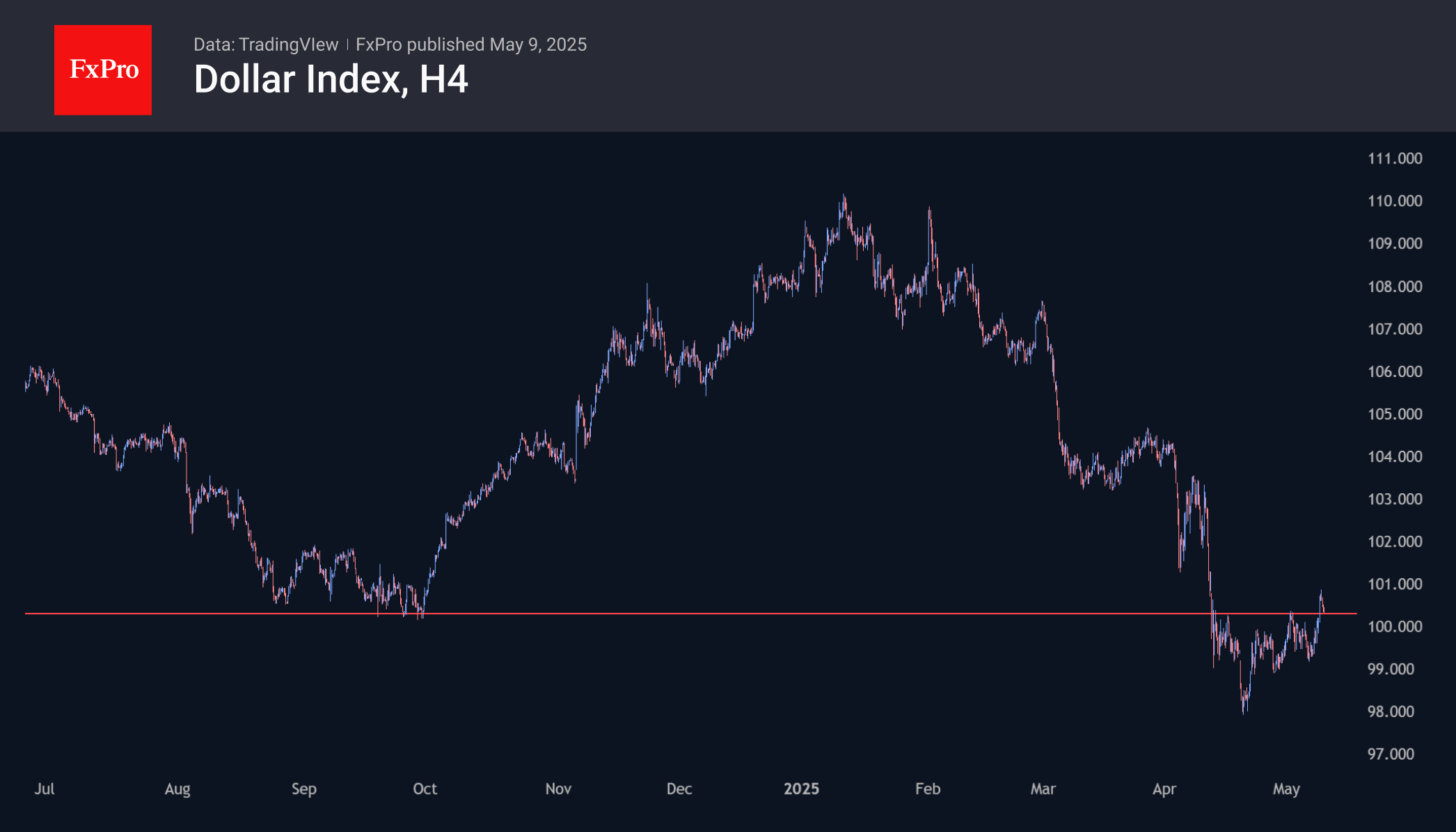

Nevertheless, the derivatives market still expects three acts of monetary easing by the Fed before the end of 2025. The reason will likely be a cooling of the US economy, which will hit the dollar. Until the end of the initial 90-day pause before tariffs hit, the Fed had no reason to cut rates. At the same time, a break of the resistance at 100.3 will increase the risks of a pullback to the downtrend in the USD index.

The FxPro Analyst Team