Gold lost almost 4% last week, the biggest drop in over two years. The price of a troy ounce fell below $1835, its lowest level since March. Gold’s sell-off last week looked like a capitulation of the bulls, with a break of multi-month support. This could soon be followed by increased volatility with new lows. It is often at times like this that market inflexion points are formed.

Last week, gold accelerated its decline by breaking the support of the downtrend channel of recent months. The last time gold traded at such a low was over six months ago, when the US regional banking crisis triggered an influx of buyers, pushing the price away from support around $1810.

Then, as now, the pressure on gold came from rising US government bond yields and a reassessment of expectations for higher long-term interest rates. In our view, the key difference in market sentiment is that a sell-off in gold accompanied last week’s sharp rise in cryptocurrencies.

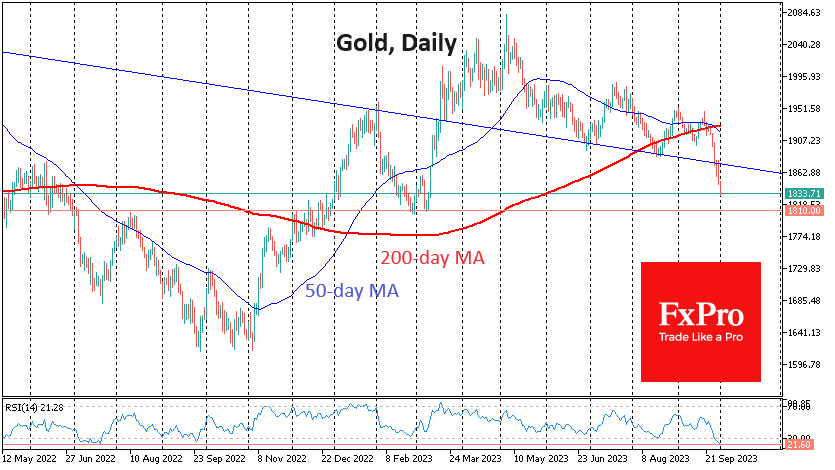

In the short term, gold is oversold, creating the potential for a corrective bounce. On the daily chart, the RSI oscillator has dropped to 21.6. The last time the indicator recorded such low levels was in June and August 2018, when a reversal from decline to growth was forming in gold for the following years.

It may well be that this acceleration in gold’s decline is a sign that the fall is nearing its end, but it is still a case where it is better to be a little late to the rally than to buy in.

After falling below $1890, gold has been in thin air territory since March with no significant support levels. The nearest support remains at $1810. Around this level, gold found buyers with deep pockets in March.

Not far from this level is the 200-week moving average. This is an essential indicator of the ultra-long-term trend. Over the past six years, gold has been bought on dips below this line, keeping it below 3.5%. This lower line of defence is not far from $1750.

If a further $80 drop from current levels is not appetising enough for long-term buyers, a new bear market in gold will have to be established.

The FxPro Analyst Team