- Positive macro statistics for the US are helping the greenback.

- Gold could rise to $4,610 per ounce in 2026.

The US dollar has been rising for seven of the last nine days, thanks to geopolitics and investors’ growing confidence in a prolonged pause in the Fed’s monetary expansion cycle. After a series of strong US economic data, the chances of a federal funds rate cut in January fell to 13% and in March to 44%. On the contrary, disappointing statistics for the eurozone may bring back the idea of a cut in the ECB’s deposit rate. Should we be surprised by the fall in EURUSD?

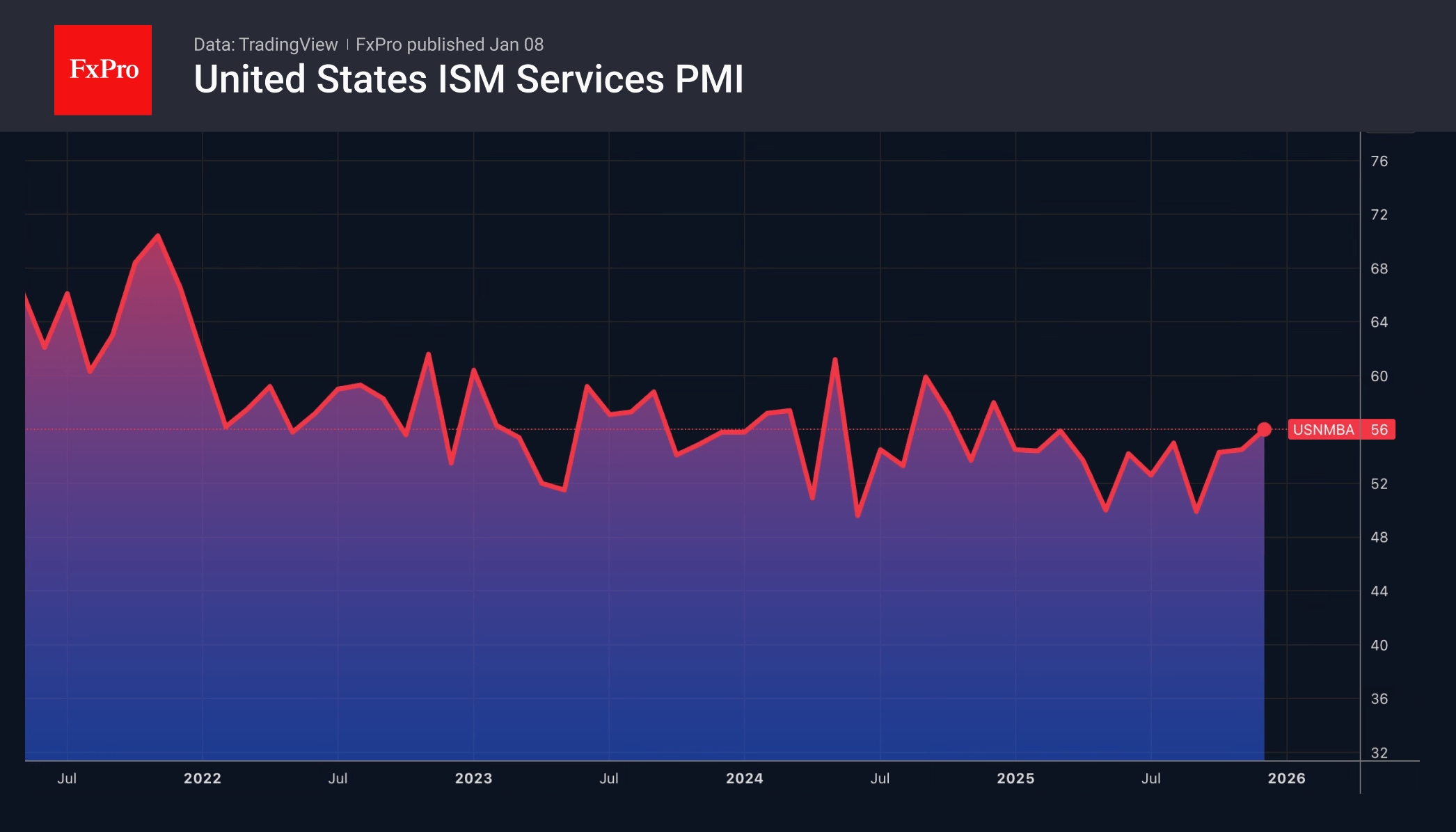

The ISM Non-Manufacturing Purchasing Managers’ Index jumped to a 14-month high. The indicator’s dynamics contrast with business activity indicators in the manufacturing sector. However, given the significantly larger share of the service sector in the economy, investors can expect positive dynamics in US GDP. This is especially true as the labour market begins to gradually recover. ADP reported a 41,000 increase in private sector employment in December.

In contrast, clouds are gathering over the European economy. A decline in retail sales in Germany and a slowdown in inflation to 2% in the eurozone have led to a fall in the economic surprises index to a monthly low and an increased likelihood of the ECB resuming its cycle of monetary expansion in the second half of the year. This is not what investors were hoping for.

At the end of 2025, there were many bets on divergence in monetary policy and a narrowing of the economic growth differential between the US and the eurozone. So far, these ideas have not been effective. The Fed intends to keep rates unchanged, while the ECB may cut them. The result is a fall in EURUSD to its lowest level since early December.

The US dollar is supported by expectations of positive US labour market statistics for December from the BLS, as well as hopes that the Supreme Court will recognise the legality of the White House tariffs. Its verdict may be delivered as early as 9 January.

The strengthening of the US dollar is causing gold to retreat. Nevertheless, Financial Times experts remain optimistic. According to their consensus estimate, the precious metal will trade at $4,610 per ounce by the end of 2026, which is 4% higher than current levels. Central banks will continue to support XAUUSD. For example, the PBoC has been increasing its gold reserves for the 14th month in a row. During this period, they have grown by 1.35 million ounces.

The FxPro Analyst Team