US equity indices have been in a state of surprising divergence for over a week, with the Dow Jones and Russell 2000 shooting up, the Nasdaq-100 working its way down, and the S&P500 treading water.

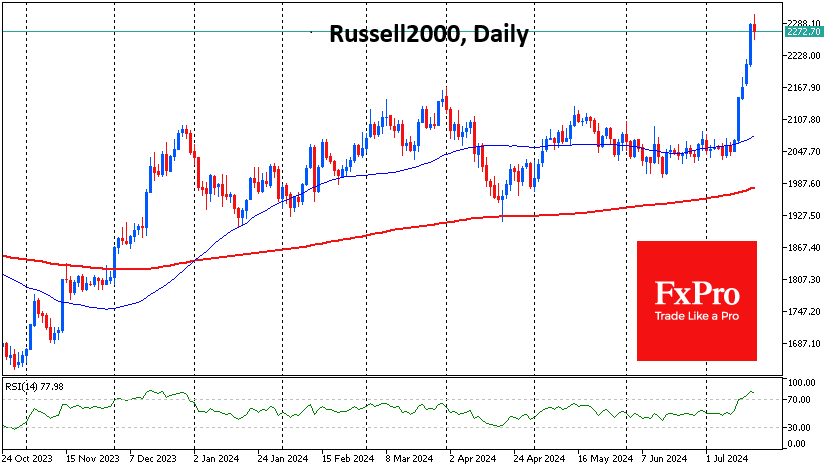

Russell 2000 futures had racked up gains for the week to 12.5% by the start of US trading. The Dow Jones 30 rose a more modest 4.5% over the same time, pushing its all-time high above 41,150. On Wednesday, the index is retreating 0.4%, as is the Russell 2000, giving up about a tenth of the week’s rally.

The Nasdaq-100 remains the heaviest among the key indices, losing 2% since the start of the day on Wednesday and 3.6% for the week, pulling back below 20,000.

The S&P500 was updating intraday all-time highs through Tuesday, but today’s 1% index pullback erased its minimal gains.

We initially welcomed the Russell 2000’s break of the long-term resistance line and its acceleration after a prolonged lull as a signal of a long-awaited rally extension. However, a persistent decline in the Nasdaq-100—the poster child of market growth—could drag the entire market down with it. In 2021, there were five weeks between the peak of the Nasdaq and the Dow Jones, but this is an exception, and often indices synchronise faster.

The FxPro Analyst Team