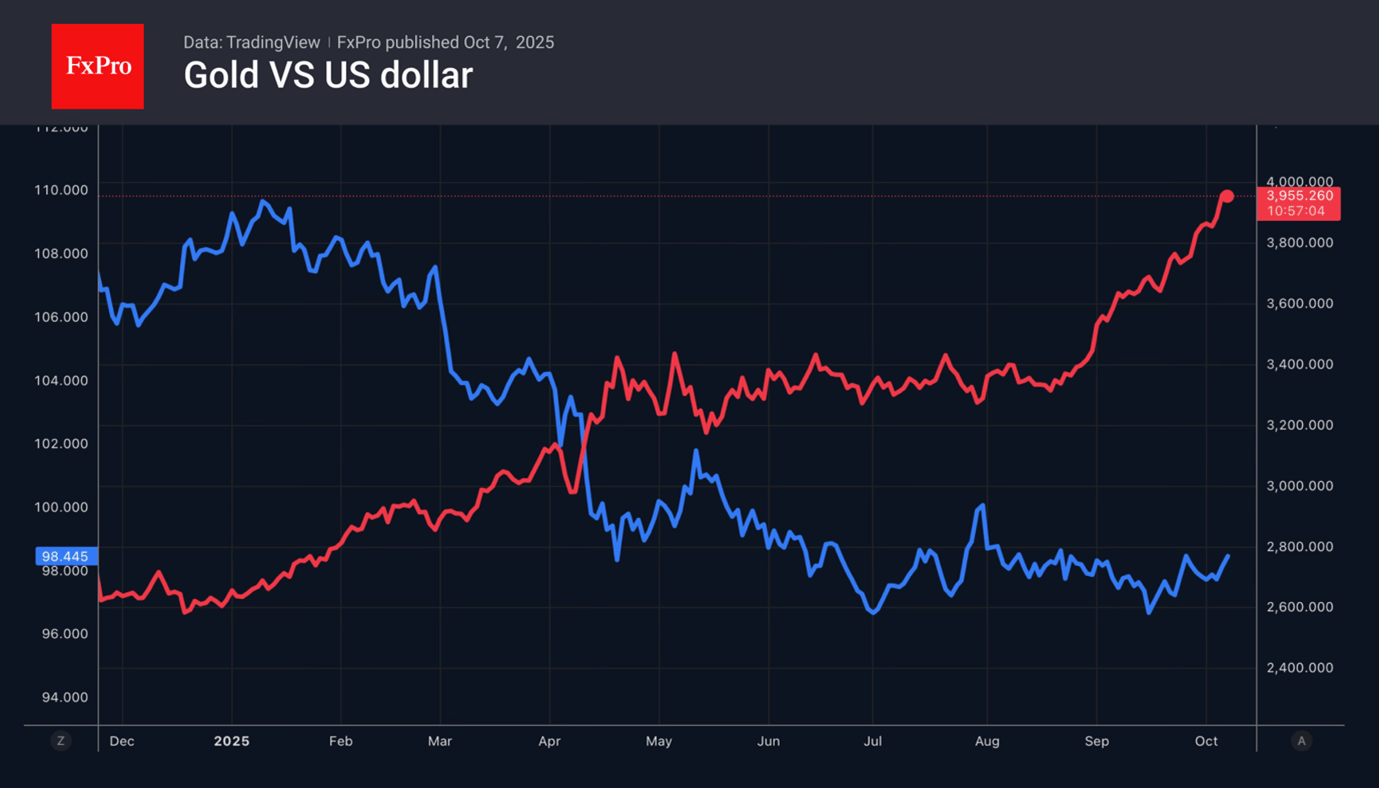

A surge of distrust in fiat currencies, or so-called currency debasement trade, has sent gold to new records. In Japan, Sanae Takaichi was elected as the new leader of the Liberal Democratic Party. She supports fiscal and monetary stimulus policies and opposes raising lending rates. Concerns about the independence of the central bank are undermining confidence in the yen.

France has seen its fourth prime minister resign in just over a year. The government cannot reach an agreement with parliament on reducing the budget deficit and public debt. The escalation of political conflict is putting pressure on the euro, and the shutdown continues in the US. In November, the Supreme Court may rule the tariffs illegal. This will require the return of $165 billion, an increase in the volume of treasury issuance, and will undermine the position of the USD.

Concerns about the growth of public debt are forcing investors to insure against the risks of financial instability. They are buying precious metals as safe-haven assets and Bitcoin as digital gold. As a result, gold ETF holdings have increased by $13.6 billion over the past four weeks. Since the beginning of 2025, they have been heading towards $60 billion, which would be a new record.

With high investment demand, Goldman Sachs has raised its forecast for precious metals from $4,300 to $4,900 per ounce by the end of 2026. Earlier, the bank talked about $5,000 if money from the treasury market flows into the gold market. There is a growing trend away from the classic portfolio structure with 60% in stocks and 40% in bonds. In the current environment, it is recommended to invest about 20% in alternatives such as precious metals and cryptos.

Gold’s record highs are due not only to the emergence of new growth drivers, but also to the preservation of old trump cards. Geopolitics, the Fed’s intention to continue its cycle of monetary policy easing, and the stagflationary backdrop in the US economy have underpinned the more than 50% rally in gold so far this year. There is increasing talk in the market about gold FOMO. Therefore, the slightest pullbacks in the precious metal are likely to allow investors to buy the dip.

The FxPro Analyst Team