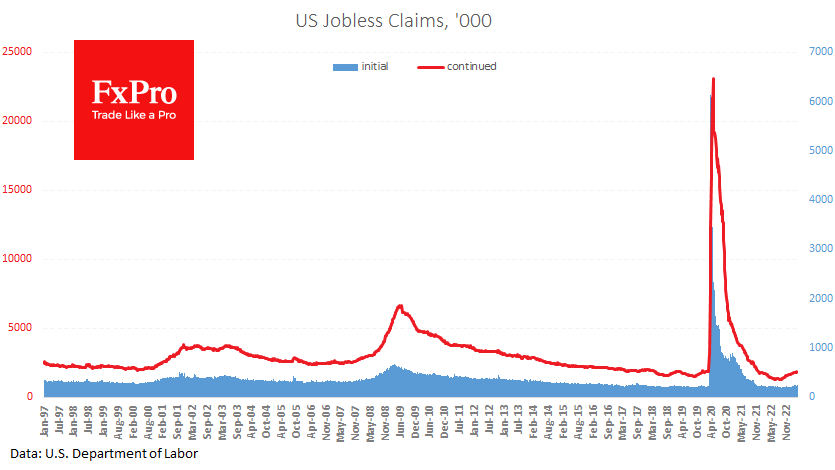

Initial jobless claims in the US came in at 245K last week, compared with the previous and expected level of 240K. This figure has been rising since the beginning of the year. It is not a pandemic spike or a sharp increase like in the second half of 2008, when the economy and financial markets plunged.

It is more like the first signs of an economic turnaround, as was the case in 2000 and 2007. These were periods of smooth business cycle reversals, but then things got out of hand.

If inflation is taken out of context, the current labour market picture suggests a weakening of equity indices and a subsequent softening of Fed policy and pressure on the dollar.

Higher inflation complicates the picture considerably as it forces traders to shift their attention from the net economy to how the Fed assesses the situation and how it intends to proceed. As a result, we should not expect a downward spiral in the USD just yet, but the overall trend so far looks bearish.

The FxPro Analyst Team