The British pound led the decline among major currencies on Tuesday, as the jump in long-term government bond yields brought the issue of fiscal discipline back into focus. Investors are paying attention to growing public debt and the unsustainability of this path.

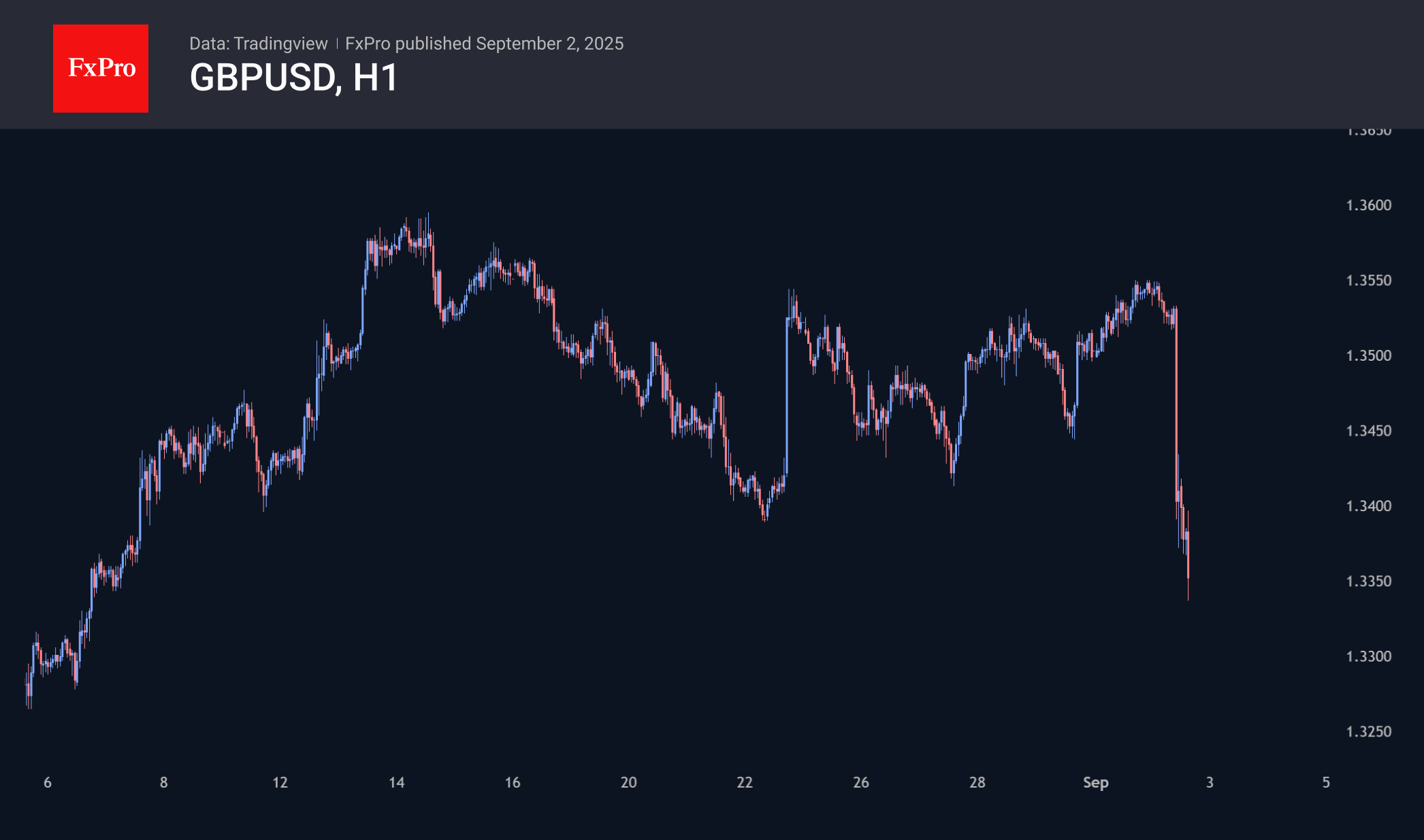

Yields on 30-year UK government bonds reached their highest level since 1998, but this did not attract buyers, only triggering a wave of flight from British assets. This caused a 1.5% decline in GBPUSD and a 1% decline in FTSE100. Incidentally, the latter has lost its sixth consecutive trading session, falling 2.5% from its historic high.

This is negative for the British currency, as it implies pressure on the Bank of England to lower the key rate, launch quantitative easing, or cut government spending, which is negative for growth and deters investors. Another option is to request assistance from the IMF, which is also not very pleasant for the economy, as was the case with Greece a decade and a half ago.

This story is yet another demonstration of the saying, ‘When America sneezes, the world catches a cold.’ This was true during the global financial crisis and remains relevant today. Concerns about demand for US government bonds are quickly turning into problems with government debt in developed countries. This is because they are more vulnerable to bond sell-offs due to their smaller market capacity.

Only the names are changing, and it is not just Britain, but also France and Japan today. Therefore, we should not be surprised by a new wave of dollar growth in the coming weeks and the spread of concerns about the sustainability of the debt burden of the Old World countries and Japan, which will boost confidence in the American currency as a safe haven. In an extreme scenario, this could justify a more aggressive reduction in the Fed’s interest rate, but without harming the dollar’s exchange rate against its competitors.

The FxPro Analyst Team