Today is a quiet day regarding data from Europe and the USA, allowing a look at data from Asia. Statistics from Japan indicate that the worst for the Rising Sun country may be over, and the weakness in the yen has provided the necessary impetus for growth.

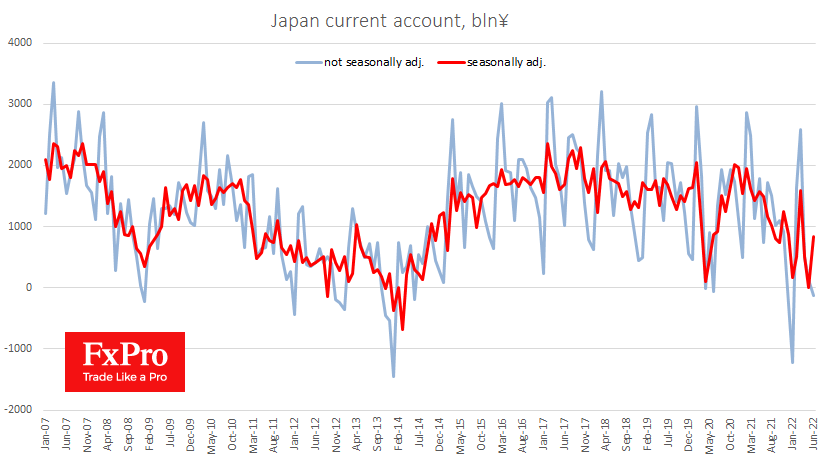

The seasonally adjusted current account closed with a surplus of 838 billion yen in June against an expected deficit of 30 billion yen – substantially better than predicted. The surplus reflects capital inflows into the country, which supports the yen after a 20% plunge against the dollar between March and July.

In addition, bank lending is recovering. Data for July showed an increase of 1.8% y/y against 1.2% a month earlier and 1.5% expected, and only +0.3% in February. The rebound in lending is an essential signal of business and household activity after years of stagnation. If the recovery continues, the Bank of Japan might decide to make a vital shift in its multi-year policy and change the parameters of QE.

This data leveraged the technical picture by reversing the USDJPY from the 50-day MA line today. Today’s downside momentum reinforced the move of this curve from the support line into resistance. We should not be surprised if further downward momentum develops to 130 from the current 134.5.

The FxPro Analyst Team