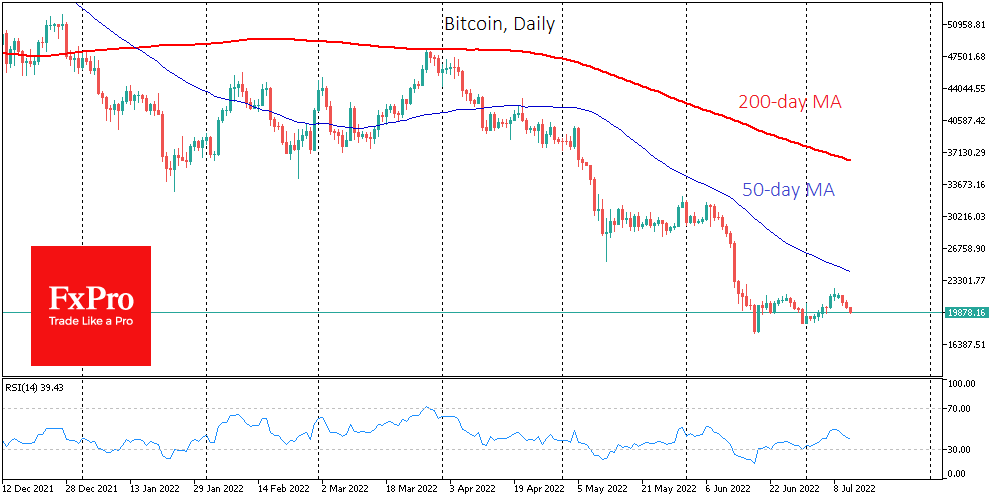

Bitcoin was down 2.5% on Monday and, continuing its decline on Tuesday morning, was back at $20,000. Ethereum has lost 5.2% in the past 24 hours to $1090. Altcoins in the top 10 fell from 1.1% (XRP) to 5.2% (Solana).

Total cryptocurrency market capitalisation, according to CoinMarketCap, sank 2.6% overnight to $891bn. The Cryptocurrency Fear and Greed Index lost 6 points, dropping to 16, and has been cruising through “extreme fear” territory for over two months.

The rising dollar and a new wave of pressure on stock indices did not escape Bitcoin on Monday amid a renewed fall in stock indices. Market dynamics indicate that sellers have been taking a pause to sell some assets at a higher price but remain the dominant force in the markets.

Investors are demonstrating a similar sentiment. More than 60% of major US crypto investors surveyed by Bloomberg MLIV Pulse expect bitcoin to fall to $10,000. If the collapse of the industry’s major projects results in significant losses for investors and causes a domino effect, the industry could face increased regulation.

Fed Vice Chair Lael Brainard said that the situation with the wave of defaults of cryptocurrency companies requires more oversight of the crypto industry. Bank of England spokesman Jon Cunliffe said the crypto industry regulation should be like traditional finance.

A remarkable transformation as cryptocurrencies emerged and were seen by enthusiasts as self-regulating instruments, rejecting, and resisting any interference and centralisation. However, if investors lose a lot of money or suspect the creators of fraud, they will likely seek protection and regulation themselves.

According to investment strategist Lyn Alden, the worst part of the crypto market’s bearish trend ended in the first half of 2022, when bitcoin lost more than 56% of its value. The massive sell-off in BTC has stopped, but further declines cannot yet be ruled out.

MicroStrategy CEO Michael Saylor said Ethereum, and other altcoins are securities because of the cryptocurrency issuer. And only bitcoin is a commodity because its blockchain cannot be changed, like the physical composition of gold.

The FxPro AnalystTeam