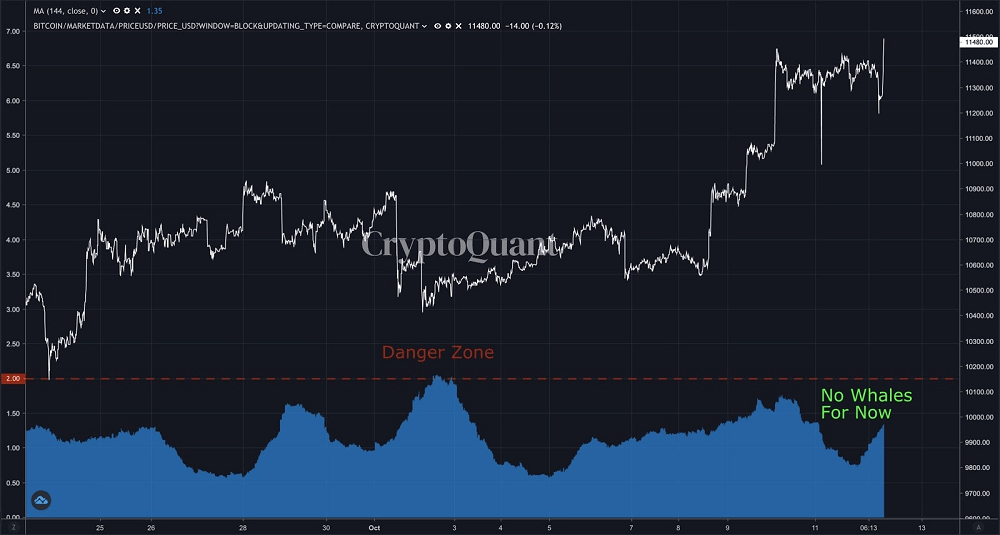

A Bitcoin (BTC) sell-off and associated price fall are “not going to happen,” a well-known the CEO of a well-known analytics tool has said. In a tweet on Oct. 12, Ki Young Ju, CEO of CryptoQuant, noted that average inflows to exchanges were staying low despite BTC price gains.

Ki highlighted CryptoQuant’s mean exchange inflow metric, which remains comfortably within the low-risk area, suggesting a low chance of a sell-off. Mean exchange inflow measures how much Bitcoin is entering exchanges, with the implication that it could be used for selling or trading activities. By extension, it gives an idea of whale activity — large volume hodlers planning to divest themselves of BTC. “$BTC dumping is not going to happen,” Ki commented.

“All Exchanges Inflow Mean usually indicates how many whales are active on exchanges. Above 2 BTC is the danger zone, and we’re still in the safe zone.” As such, BTC/USD climbing to near $11,500 this week has not increased investors’ temptation to sell.

The lack of activity runs in stark contrast to earlier this year. On March 9, a week before coronavirus caused a cross-asset price crash, exchange inflows passed the 2 BTC “danger zone.” Days later, around March 14, inflows hit a peak of almost 5 BTC. Bitcoin subsequently fell to $3,600.

Bitcoin price dump ‘not going to happen’ as whales stay off exchanges, CoinTelegraph, Oct 13