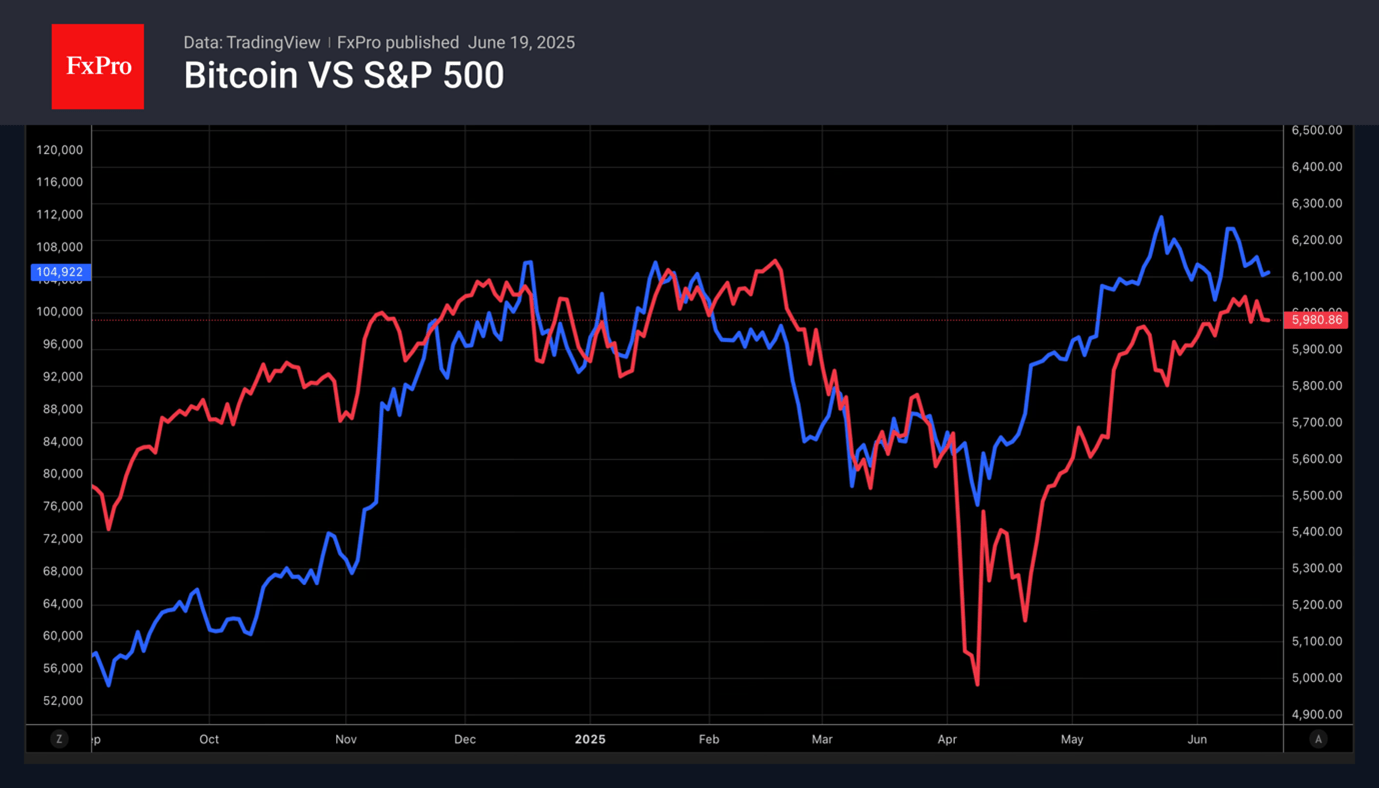

While Bitcoin is consolidating in the spot market, the futures market is signalling growing risks of a Bitcoin correction. Traders are hedging against the risk of a pullback to $100,000 and below against the backdrop of escalating geopolitical conflict. This significantly worsens global risk appetite and increases uncertainty in the Fed’s monetary policy. Jerome Powell expects a significant acceleration in inflation in the US. This is not good news for US stocks and income assets in general.

The ratio between put and call options on Bitcoin on the Deribit cryptocurrency derivatives exchange jumped to 2.17 in one day, signalling high investor demand for protection.

The news of Congress passing legislation on stablecoins failed to help Bitcoin. The United States, led by the president, is confirming its loyalty to the crypto industry. Since Donald Trump’s victory in the presidential election, Bitcoin has risen by 50%.

Its future largely depends on developments in the Middle East. Escalation in the form of other countries getting involved and Iran blocking the Strait of Hormuz could lead to a further deterioration in global risk appetite and a rollback of the upward trend in the coin.

The FxPro Analyst Team