Market picture

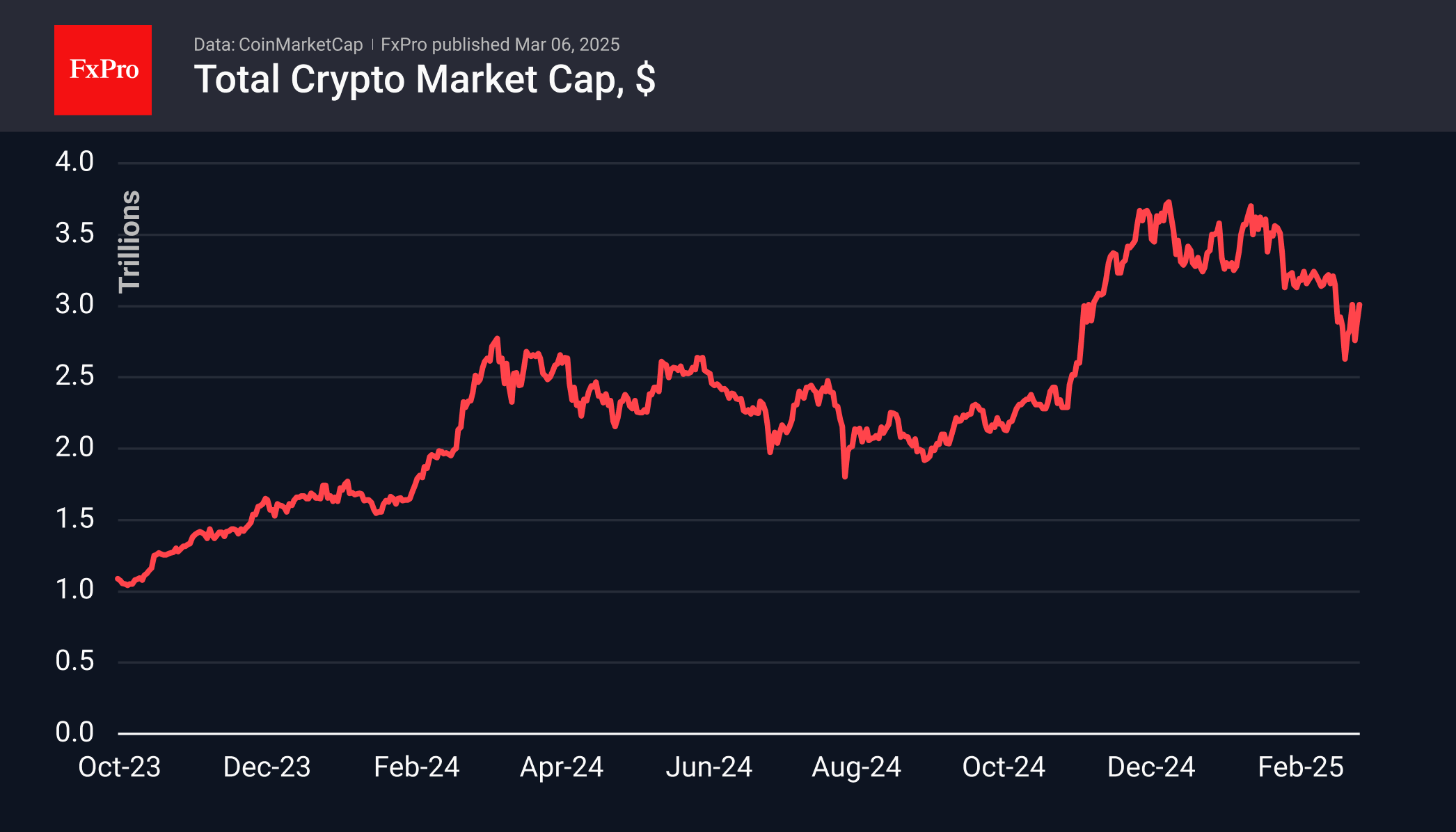

Crypto market capitalisation returned to the $3 trillion area towards the end of the week ahead of the first crypto summit in the Oval Office. In the short term, buyers on downturns were strong enough to buy back two powerful selloffs. However, an important test of the previous support level at $3.15 trillion is ahead.

Sentiment is moving away from the low point but remains in formal extreme fear territory at the 25. As intended by the creators of such indices, a recovery from this area represents a buying opportunity. We still consider the market reaction after Friday’s summit to be an important confirmation signal.

Bitcoin is gaining for the third day, having pushed off from support in the form of the 200-day moving average. The ascent is more measured this time compared to the market pumping last weekend. But we are cautious of talking about a bullish victory until BTCUSD breaks above the 50-day moving average, which is now at $97,000.

Ethereum is trading near $2300 and trying to break out, but for now, it remains below levels before the Republicans won the election in November. So far, its momentum should be characterised as a technical rebound after a strong selloff rather than the start of a recovery.

News background

Trump will announce a ‘significant’ change in crypto policy, including plans for a Bitcoin Strategic Reserve at a White House summit on 7 March, US Secretary of Commerce Howard Lutnick said. Bitcoin will receive ‘special status’, and other cryptocurrencies will also be treated ‘positively’, he said.

Mexican billionaire Ricardo Salinas said that 70% of his investment portfolio is allocated to Bitcoin-related assets. The remaining 30% comes from gold and gold mining companies.

Despite BTC falling below $90,000, El Salvador expanded its national bitcoin reserve by 19 BTC, again deviating from its plan to buy one coin per day. El Salvador’s president said the country will continue to accumulate bitcoins despite pressure from the IMF.

CryptoQuant calculated that the unrealised gains of market participants holding between 1,000 ETH and 10,000 ETH have turned negative, showing the worst levels since the previous bear market.

The FxPro Analyst Team