Cryptocurrency mining profits are on the way down, resulting in declining demand for hardware, such as high-end graphics cards. Sources suggest that GPUs could drop by as much as 20% within the upcoming month.

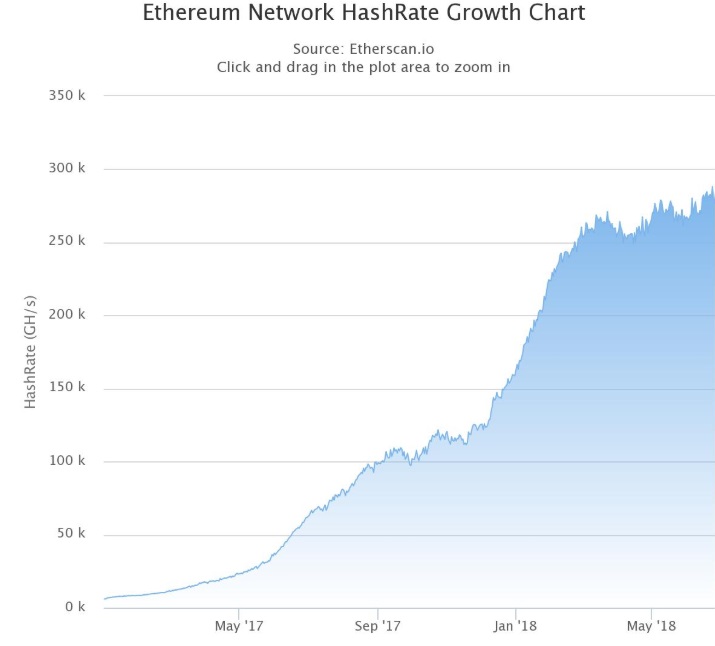

DigiTimes, a premier Asia-based technology news source, has suggested that there has been a large decrease in interest for mining hardware. Cryptocurrency mining was unarguably one of the largest trends last year, with mining hashrates growing at an exponential rate. Ethereum, one of the most popular mined currencies, had its hashrate grow by over 25 times last year. Additionally, prices for mining hardware rapidly increased, reaching unsustainable prices that were often unaffordable for common consumers and gamers. However, due to waning cryptocurrency prices, coupled with a large increase in mining difficulty, mining growth has ground to a near halt.

Take the example of Ethereum’s hashrate, which shows an eerie correlation between price action and mining interest, in the form of hashrate growth. Many hardware manufacturers, like Nvidia and AMD, overestimated future demand for graphics cards, leading to an overstock in hardware. Nvidia, the most prominent GPU manufacturer, is reported to have a supply of over one million GPUs in its warehouses. Bitmain, the largest ASIC manufacturer, has pushed out new mining machines for the Equihash and EthHash algorithms, which easily outperform GPU miners. ASICs provide an exponentially higher $/hash rate in comparison with graphics cards, making them an attractive option for miners.