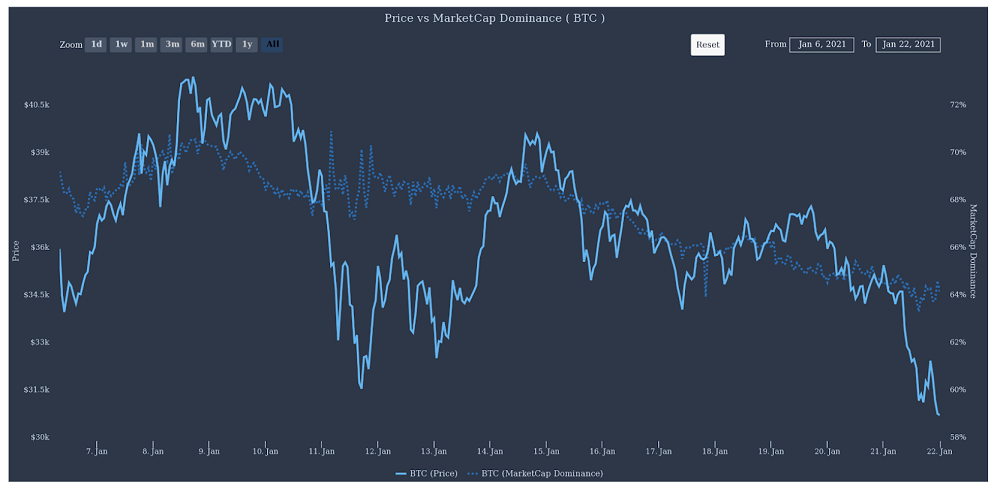

On Jan. 21 the cryptocurrency market experienced an increased wave of selling pressure and within the last hour Bitcoin (BTC) price dropped below the $30,000 mark for the first time since Jan. 4. Now that Bitcoin has lost the $32,000 and $30,000 support, a growing number of analysts are suggesting that the price could retest the $24,000 support. One theory behind the dip suggests that institutional investors viewed Bitcoin as a crowded trade and decided to take profits.

As reported by Cointelegraph, Scott Minerd, the Guggenheim’s chief investment officer, recently suggested that the price of Bitcoin has “likely put in a top” for 2021 and could see a “retracement back toward the 20,000 level.” JPMorgan strategists John Normand and Federico Manicardi also warned that investors using BTC “as a portfolio diversifier are putting themselves at risk” as Bitcoin is more of a cyclical asset than a hedge.

This note of caution seems to have been well timed given today’s show of volatility. Although sell-offs can be painful for investors who are overleverged, taking a closer look at some of the social activity that occurred during the downside move hints that the current volatility might not be a macro trend change.

Crypto market cap falls by $113B as Bitcoin price tumbles to $28,750, Reuters, Jan 22