The great cryptocurrency crash of 2018 is heading for its worst week yet. Bitcoin sank toward $4,000 and most of its peers tumbled on Friday, extending the Bloomberg Galaxy Crypto Index’s decline since Nov. 16 to 23 percent. That’s the worst weekly slump since crypto-mania peaked in early January.

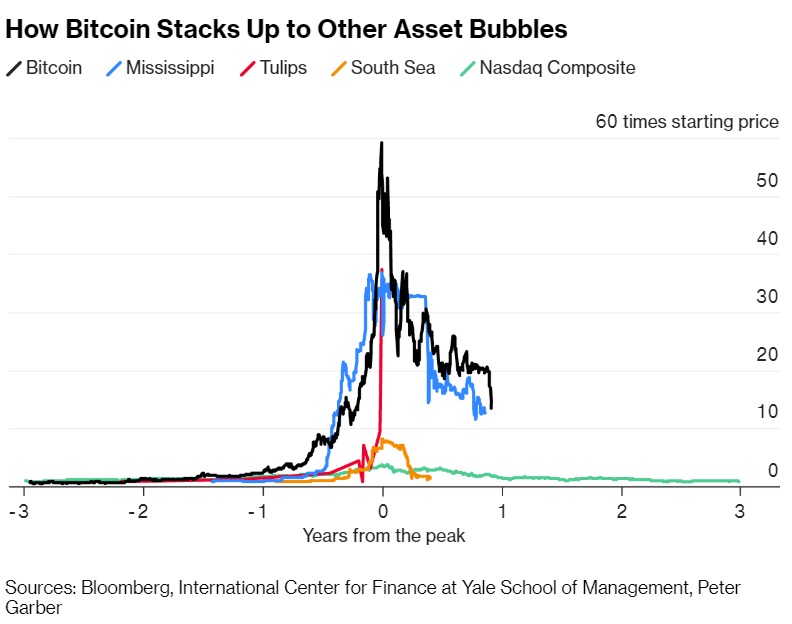

After an epic rally last year that exceeded many of history’s most notorious bubbles, cryptocurrencies have become mired in a nearly $700 billion rout that shows few signs of abating. Many of the concerns that sparked the 2018 retreat — including increased regulatory scrutiny, community infighting and exchange snafus — have only intensified this week. Even after losses exceeding 70 percent for most virtual currencies, Oanda Corp.’s Stephen Innes has yet to see strong evidence of a capitulation that would signal a market bottom.

“There’s still a lot of people in this game,” Innes, head of trading for Asia Pacific at Oanda, said by phone from Singapore. If Bitcoin “collapses, if we start to see a run down toward $3,000, this thing is going to be a monster. People will be running for the exits.” Innes said his base-case forecast is for Bitcoin to trade between $3,500 and $6,500 in the short term, with the potential to fall to $2,500 by January.

The largest cryptocurrency retreated as much as 7.6 percent on Friday, before paring losses to 4.1 percent at 4:43 p.m. in Hong Kong, according to Bloomberg composite pricing. At $4,244, it’s trading near the lowest level since October 2017. Rivals Ether, XRP and Litecoin all declined at least 5 percent. The market value of all cryptocurrencies tracked by CoinMarketCap.com sank to $138 billion, down from about $835 billion at the market peak in January.