Market Picture

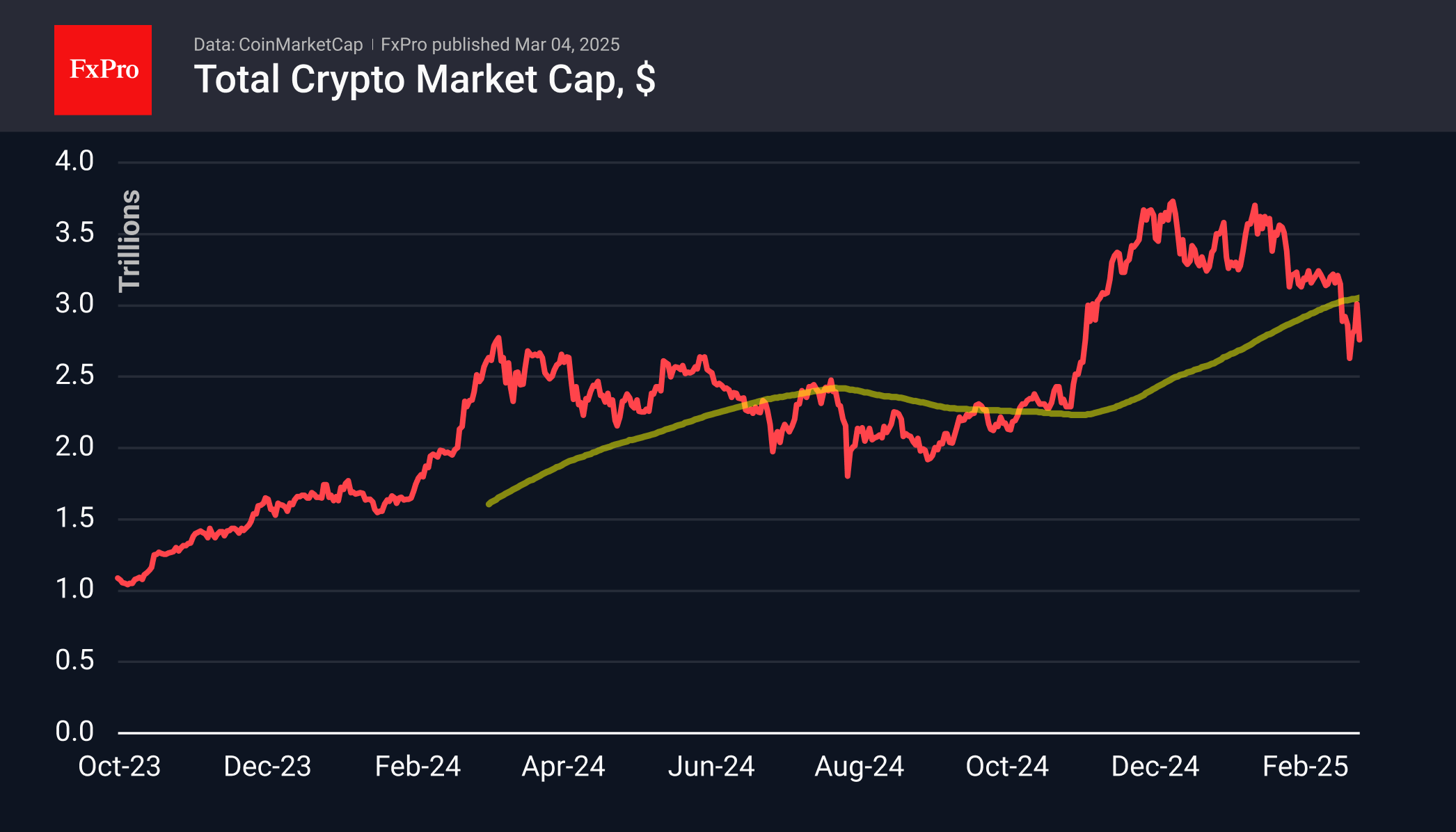

Pressure in traditional markets has clipped the wings of the crypto market, which is almost back to the point from which Sunday’s rally started. At the start of the day on Tuesday, it was capitalised at $2.76 trillion, having lost over 9% in the last 24 hours. The market fell under the 200-day average on increased momentum, and an attempt to rebound failed even with the help of cryptocurrency news.

Sentiment in the cryptocurrency market has returned to extreme fear territory, to the 15 level – the second lowest level after 27 February in more than two and a half years.

Bitcoin has lost 9.5% over the past 24 hours to levels below $83.3K. It continues to flounder between the 50- and 200-day moving averages but is dangerously assessing the latter this week. A failure below formally triggers a bearish scenario, with the potential next stop in the $70-72K area. That said, it is clear how uncomfortable this decline is for the current administration, and it may go for new industry proposals to support sentiment.

News Background

According to CoinShares, global crypto fund investments fell by a record $2.911 billion last week. Bitcoin investments were down by $2.598 billion, Ethereum by $300 million, and Solana by $7 million. Sui investments were up by $16 million, and XRP by $5 million.

CoinShares suggests that several factors, including the recent Bybit hack and the preceding 19-week streak of $29bn, influenced this trend. These factors have led to profit-taking and weakened sentiment towards this asset class.

Mint Ventures draws attention to the significant sponsorship that the companies behind XRP, SOL and ADA gave Trump before and after the election. However, this absurd approach could further reduce the likelihood of a relevant bill being passed at the federal level.

Bitcoin is not suitable for inclusion in government reserves because cryptocurrencies lack stability, liquidity and security, Swiss National Bank Governor Martin Schlegel said.

A US court dismissed the SEC’s lawsuit against Richard Hart, founder of HEX, PulseChain, and PulseX. The regulator accused Hart of raising more than $1bn through unregistered cryptocurrency offerings through the HEX, PulseChain, and PulseX projects.

The FxPro Analyst Team