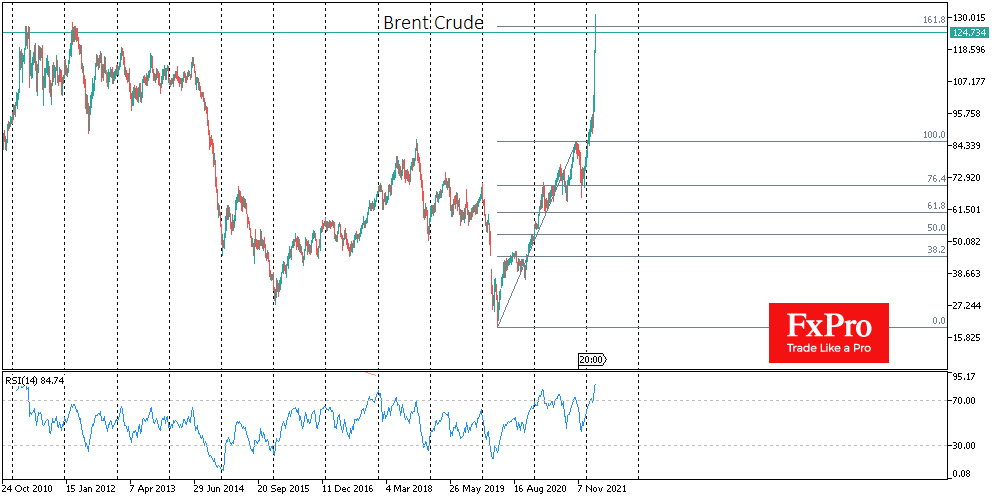

A barrel of Oil on the spot market briefly topped $130 for Brent and $125 for WTI, having retreated to $127 and $121, respectively, by the start of European trading. Oil received its latest boost on expectations that the US will announce an embargo on Russian energy imports.

Traders took short-term profits on Biden’s speech, which kept Oil rising further. On the sellers’ side was also news that the UK was unable to repeat the US move and is instead set to halt energy imports from Russia before the end of the year. Biden also noted that many European countries would not stop buying Russian Oil and Gas any time soon because of their heavy reliance on them.

The latest comments have somewhat dampened pressure on the Oil price, as have earlier International Energy Agency calculations on ways to reduce Europe’s energy consumption from Russia by up to 80% as early as this year. Such plans often over-idealise the possibility of a coordinated effort, but their mere appearance has a stabilising effect on the market.

For its part, Russia has also worked to prove its role as a reliable energy supplier, loading Crude Oil at ports in line with the schedule.

Nevertheless, markets continue to face an increased risk premium, and Russian Oil struggles to find new buyers. The UAE and Saudi Arabia try to use the situation to their advantage, refusing to cooperate with the US to increase oil supplies. Iran is haggling for more favourable terms on the nuclear deal. Russia, the architect of the deal, has suddenly become an obstacle to it, demanding legal guarantees from the US that sanctions will not affect Russian-Iranian trade, thereby trying to thwart the US attempts to increase oil supply in countries where US sanctions limit production.

We would venture to guess that all existing conditions are already built into the Oil quotes, and its price is now near a ceiling for the coming weeks and months. From here, we could see the establishment of a fairly broad corridor of $95-130 per barrel for Brent for the foreseeable future. This is a vast range, reflecting the outlook’s persistence of extreme volatility and extreme uncertainty.

The FxPro Analyst Team