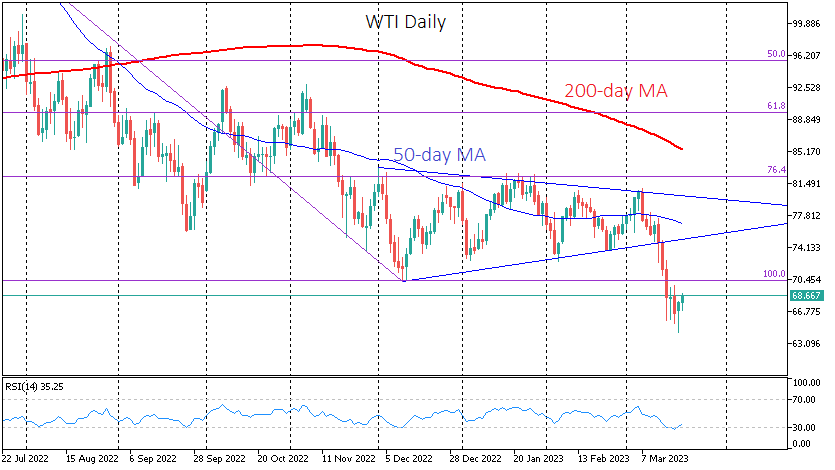

By the start of European trading on Monday, WTI had lost over 20% from its high of $80.96 on 7 March to a low of $64.36. The sell-off that intensified last week may well be giving way to a new buying impulse in oil. Oil is broadly back in long-term equilibrium, and it would take a significant shift in the supply/demand balance to trigger a further sell-off or a new round of growth.

Between December and early March, prices consolidated in a narrowing range with an equilibrium point near $77/bbl. This pattern had a good chance of breaking the lower end of the spectrum.

Powell’s speech to Congress sent oil out of risky assets on fears of a sharp rate hike. However, the lower boundary of the triangle was stormed by WTI on the contrary, on fears that the banking crisis would slow economic growth and dampen demand.

Technical factors played an equally important role in the bearish move: a break of the three-month range triggered a capitulation by medium-term speculators, reinforcing the downward movement.

The March sell-off took oil into the over-bought territory on the daily RSI. Yesterday’s intraday reversal, complemented by today’s buying, brought the index back into neutral territory, signalling at least a corrective bounce.

Moving to higher timeframes, after a short-term dip, oil buyers yesterday came back below the 200-week moving average, which acts as a long-term trend indicator. Yesterday’s approach to the $64 level has also been a turning point for oil over the past four years, working as resistance until April 2021 and support after that.

Yesterday’s lows were also close to 50% of the entire spot trading range from the lows of April 2020 to the highs of June last year.

A change in fundamentals would be needed for oil to go permanently lower. For now, we are seeing attempts by central banks to stabilise banks, bringing back demand for risky assets. At the very least, this buys time for the oil to recover in the short term.

A pullback from meaningful levels could see WTI bounce back to $71.50 or even $74 in the coming weeks. However, a sustained rally above oil would require more than a technical shake-out but a change in the fundamental backdrop.

The FxPro Analyst Team