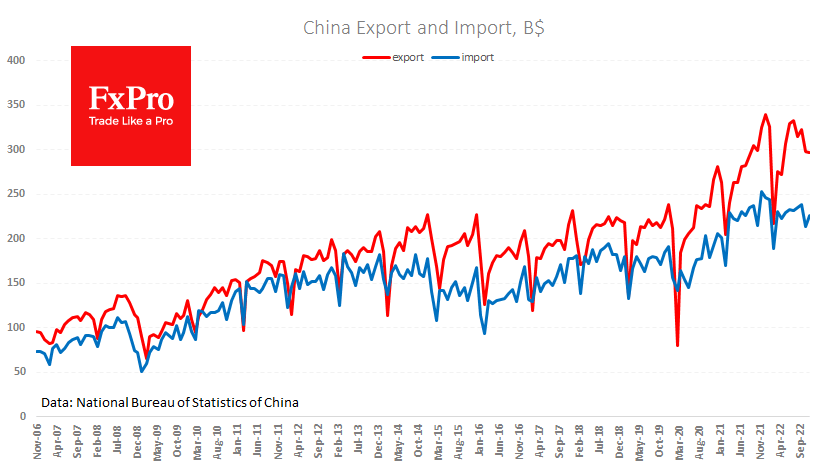

Last month, China’s harsh lockdown measures negatively impacted foreign trade. Exports fell by 8.7% YoY; imports lost 10.6% YoY. Economists, on average, were expecting half the rate of decline. Trade surplus shrank to $69.84B in November from $85.15B a month earlier and is much weaker than the forecasted $79B.

Overall, the figures are far from disastrous. Cumulatively, over 11 months, exports are up 9.1%, and imports are up 2%, marking a slowdown but not yet a decline. This is the high price of tight travel restrictions, easing gently in recent weeks. The loosening of these restrictions looks more like a concern for the economy but not a concession to protesters.

China’s foreign trade decrease in November should also be seen as a sign of how monetary tightening and the severity of energy prices in Europe are hurting the economy. For markets, such data is a new reason to reduce risk appetite, which we see early on Wednesday. Also, since the beginning of the week, the offshore renminbi has stabilised just below 7.0 to the dollar after an impressive 5.5% increase during November.

The released batch of data may be followed by further easing the zero- covid policy to avoid unnecessarily restraining of the economy. Still, it is also possible that we will see further monetary policy easing (good for the stocks and bad for the renminbi).

The FxPro Analyst Team