The combination of COVID-19 and a failure to secure a post-Brexit trade deal with the European Union could cost the United Kingdom around 134 billion pounds ($174 billion) each year in lost GDP for a decade, research by law firm Baker & McKenzie showed. Prime Minister Boris Johnson has set Oct. 15 as a deadline for clinching a post-Brexit trade deal which would kick in when the United Kingdom leaves informal EU membership at the end of this year.

The COVID-19 outbreak will cut Britain’s GDP by 2.2% below the levels anticipated before the outbreak, Baker & McKenzie said in a report titled “The Future of UK Trade: Merged Realities of Brexit and COVID-19.” On top of that, Brexit, even with a trade deal, would cut GDP by 3.1% in the long-run relative to a hypothetical scenario where the UK remained in the EU, while exports of goods would be 6.3% lower, Baker & McKenzie said. But without a trade deal, the cost of Brexit would increase to 3.9% of GDP in the long run, Baker & McKenzie said.

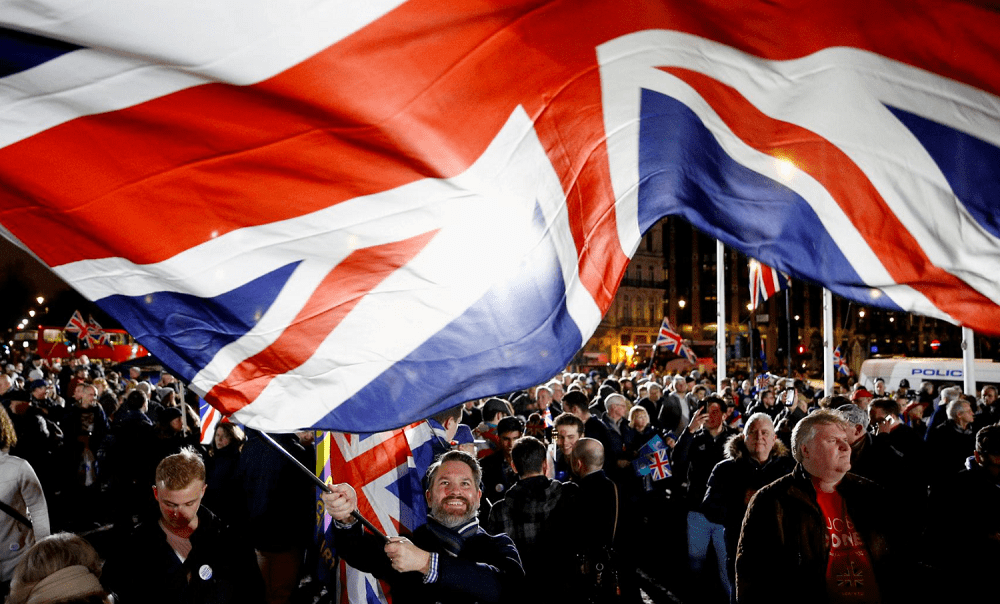

Opponents of Britain’s exit say Brexit will cost the country dearly in both money and power for decades to come, though supporters say estimates of the economic impact have been overly pessimistic. Supporters of Brexit say that while there will be some short term costs, the long term economic and political benefits could far outweigh the costs as the United Kingdom would be free to shape its own priorities.

COVID-19 and no-deal Brexit could cost UK $174 billion a year: Baker & McKenzie, Reuters, Oct 5