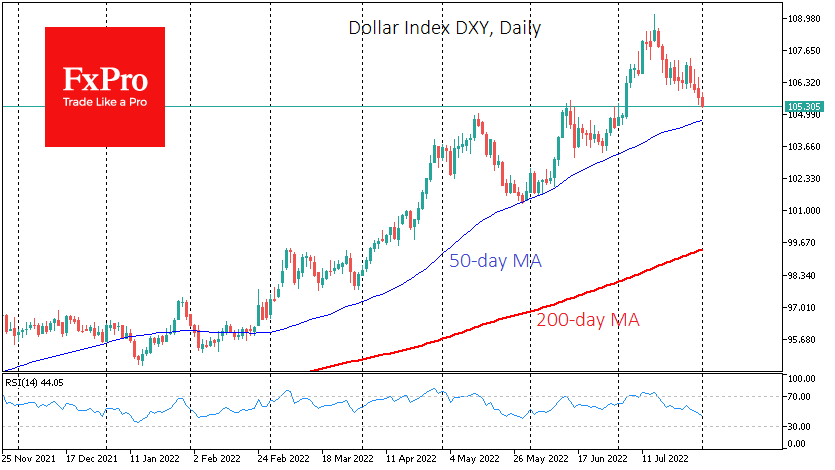

The last two weeks of July have seen a pullback in the markets towards risky assets, with the dollar retreating from multi-year highs against major currencies.

Over the past two weeks, signs of an economic slowdown in the US have reinforced the markets’ bets that the Fed will start cutting interest rates as early as the middle of next year, much more quickly than previously thought.

Although US officials do not recognise the onset of a recession after two quarters of GDP falling, markets are largely indifferent to such formalities. They are more focused on data and economic forecasts.

If one looks at the market dynamics, one would conclude that the markets consider the current pace of policy tightening too severe for the economy. Over the last two quarters, the US economy has lost 0.6%, and although suffering from the energy crisis Europe added 1.2% in the first half of the year.

US policymakers, including Powell and Yellen, point out that the economy is actively creating jobs, with a historically very high employment rate. But it is up to us to determine whether these observations are a relic this week.

From the following monthly employment report, the markets expect an increase in employment of 250k, but at the same time a fall in wage growth, which will only further widen the gap to inflation. During the week, market investors and traders will try to pick up signals from indirect indicators such as the ISM manufacturing and service sector indices and weekly jobless claims.

How strong the labour market was in July may determine whether we see a minor corrective pullback in the dollar before further gains or a global reversal of more than a year uptrend in USD.

The FxPro AnalystTeam