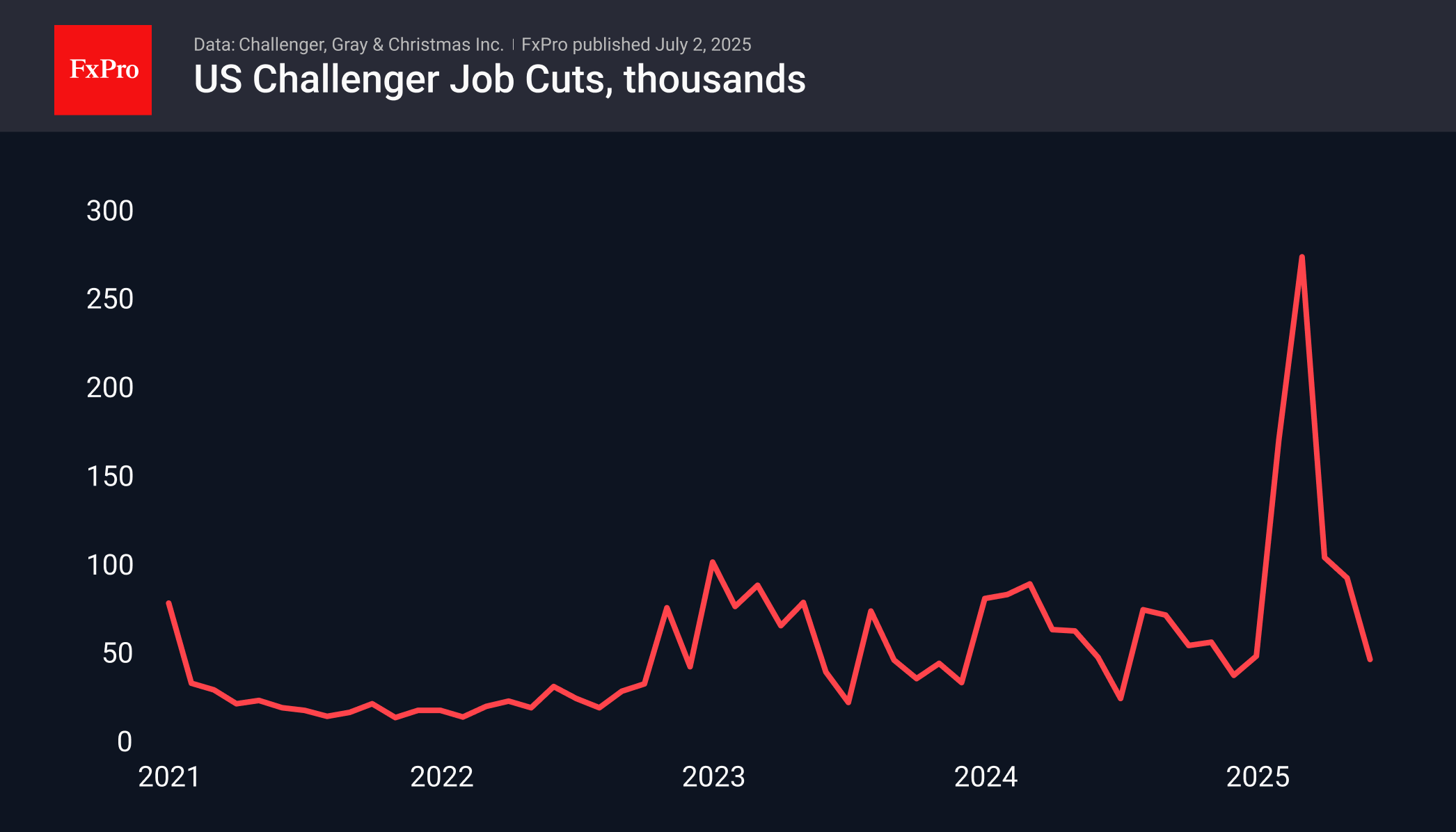

ADP data for June showed a decline in US private sector employment of 33,000, the first decline since March 2023. However, as was the case then, this may be a temporary setback, as the indicator of planned layoffs showed a decline from nearly 94,000 to 48,000 last month, which is 1.6% less than a year earlier. Planned layoffs peaked in April, when companies were shocked by the severity of tariffs, but the situation has stabilised in recent months.

The publication of ADP figures could cause increased market nervousness, reducing risk appetite, as it showed a steady decline in labour market activity from a peak of +221,000 in October, with a gradual decline and a shift to contraction in the month just ended. The official figures released on Thursday show the same overall trend, but can vary significantly from month to month. Last October was the first month of decline by 1,000 between two strong months.

The influential new job openings indicator released on Tuesday showed growth for the second month in a row, rebounding from local lows. This is an additional indicator that the economy is recovering from the shock, avoiding a further slide into recession. These are good signals for the stock market. They may also prove to be moderately neutral for the dollar if there are no further signs of accelerating inflation.

The FxPro Analyst Team