Indices

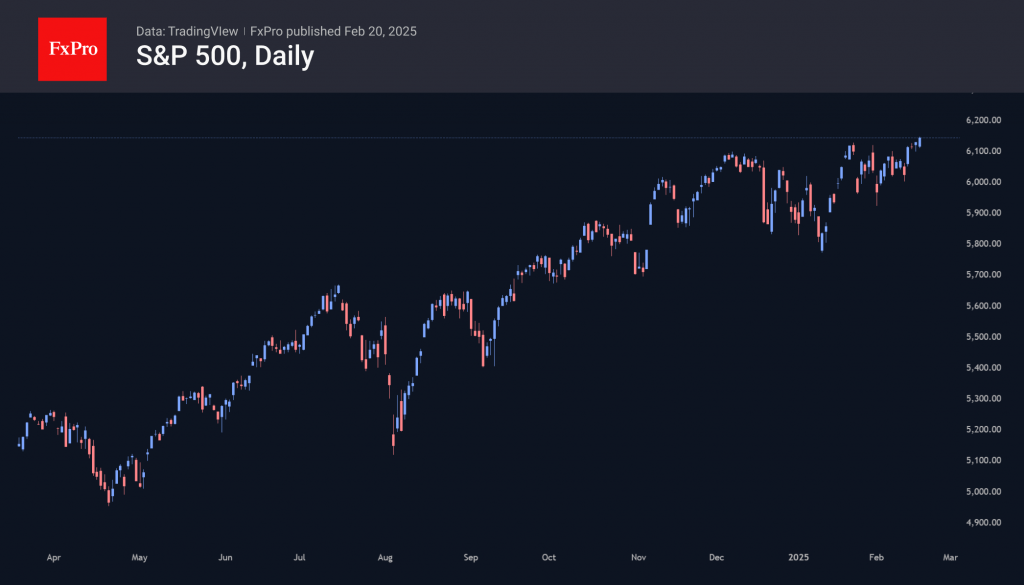

This week, the S&P 500 and Nasdaq 100 reached new all-time highs. While the Nasdaq 100 continued to push higher after a strong start following the long weekend, the Dow Jones and S&P 500 traded within a narrowing range. This pattern suggests the need for close monitoring, as the market remains vulnerable to a potential pullback.

The U.S. market is now being driven by neutral sentiment. The corresponding index from CNN Business has climbed to 48, maintaining the upward trend since January 13th, when sentiment pushed back from the fear area at 27.

European indices, which have overtaken their U.S. counterparts in gains since the start of the year, experienced a bout of profit-taking this week. The DAX index, which has added 14% since the start of the year, corrected 2% from its peak, but buyers once again dominated the market on Thursday.

Gold

So far this year, gold has made ten new all-time highs, climbing above $2950 per ounce and gaining 12.5% YTD. In terms of gains since October 2023, when the momentum started, gold is competing with European indices, gaining 63% versus just under 60% for the DAX40.

This is the eighth nonstop week of gold’s rally after consolidating late last year. While retail short-term speculators look forward to a test of the all-important $3000 ground level, we are reminded of the higher technical potential up to $3400.