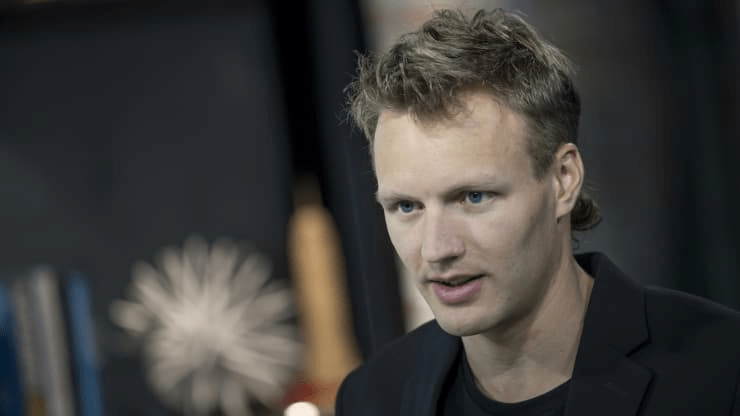

Cryptocurrency exchange Coinbase will go public on Wednesday via a direct listing that’s expected to value the start-up at more than $90 billion when it starts trading this afternoon under the stock ticker “COIN”. But when Coinbase first launched nine years ago, it hired its very first employee after receiving an enthusiastic, but “annoyingly long” cold email. And the company paid him in bitcoin. That email came from Olaf Carlson-Wee, who in 2012 had just graduated from Vassar College with a degree in sociology. He’d written his undergraduate thesis on bitcoin “and the larger implications of open source finance.”

He was also one of Coinbase’s earliest users and he wanted to work there, he said in a 2016 interview with the blog for Y Combinator (the influential tech startup accelerator where Coinbase got its start, and which is an investor in the company). “I literally cold emailed jobs@coinbase and said, ‘I love bitcoin. Here’s my thesis. I’ll do any job,’” Carlson-Wee told Y Combinator. After becoming employee No. 1 with a job in customer support at the then-fledgling company, for his three years there, Carlson-Wee was paid entirely in bitcoin, according to the Wall Street Journal, with a starting salary of $50,000.

Though it’s unclear how much bitcoin Carlson-Wee currently owns, during that time — from 2013 to 2016 — the price of bitcoin fluctuated dramatically. In early 2013 the price was just over $13 per bitcoin before spiking to more than $1,100 later that year. The cryptocurrency ended 2016 at roughly $1,000 and on Wednesday it was trading at more than $62,000. When Carson-Wee sent that cold email, despite attaching his roughly 90-page thesis, he actually heard back from one of Coinbase’s two co-founders, former Goldman Sachs trader Fred Ehrsam, five minutes later with an email asking if Carlson-Wee could “hop on a Skype.”

After talking to Ehrsam on Skype for roughly 20 minutes, Carlson-Wee said the Coinbase co-founder invited him in for an in-person interview in San Francisco (Ehrsam was staying with a friend in nearby Oakland). Ehrsam told Carlson-Wee to prepare a pair of 15-minute presentations: ”‘The first should explain something complicated you know very well. The second should outline your vision for Coinbase,’” Carlson-Wee says he was told. Carlson-Wee said his first presentation was on “the pharmacological induction of lucid dreams,” noting in 2016 that he had been “writing down my dreams for 11 years.” As for his strategy for Coinbase, Carlson-Wee said he thought the company should “focus 100% on security,” especially in terms of ensuring that users’ cryptocurrency balances were secure from hackers. “Bad customer experiences will eventually be forgotten but a security incident will not be forgotten,” Carlson-Wee told Y Combinator. “I was saying to [co-founder Brian Armstrong], ‘We cannot hack something together that ends up leading to a security incident. Even though everything is on fire, let’s do this very carefully.’ And I think that resonated with them.”

Coinbase’s first employee in 2013 cold-emailed the founders for a job — and was paid in bitcoin for 3 years, CNBC, Apr 16