– Coca-Cola reversed from support level 61.00

– Likely to rise to resistance level 63.00

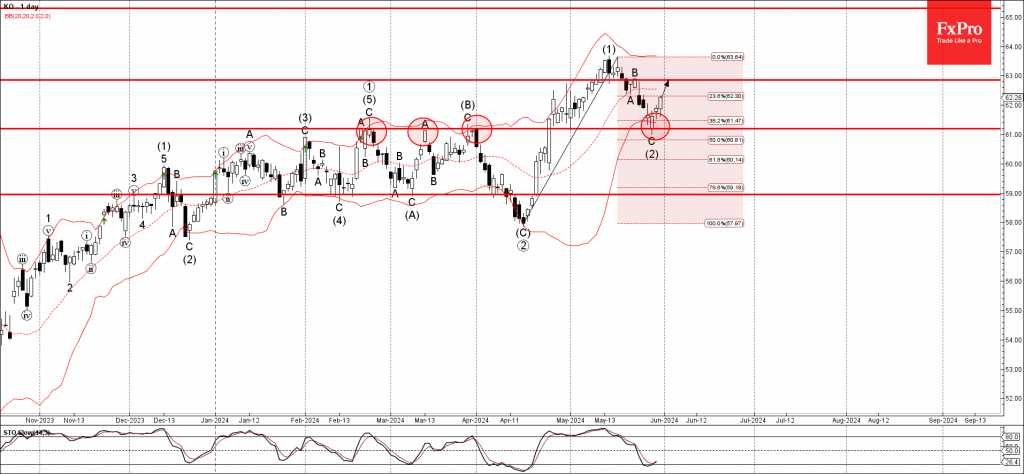

Coca-Cola recently reversed up from the key support level 61.00, former resistance from February, March and April.

The support level 61.00 was strengthened by the lower daily Bollinger Band and by the 38.2% Fibonacci correction of the upward impulse (1) from April.

Given the clear daily uptrend, Coca-Cola can be expected to rise further to the next resistance level 63.00 (which stopped the previous minor wave B).