“Sustainable business” has become a buzzword in the corporate world, and climate change is a key topic at this year’s gathering of political and business leaders at the World Economic Forum in Davos. But while chief executives have told CNBC that becoming more sustainable and carbon neutral were immediate goals for their firms, a survey of CEOs released Monday revealed that climate change issues were not even ranked among the top 10 threats to business growth.

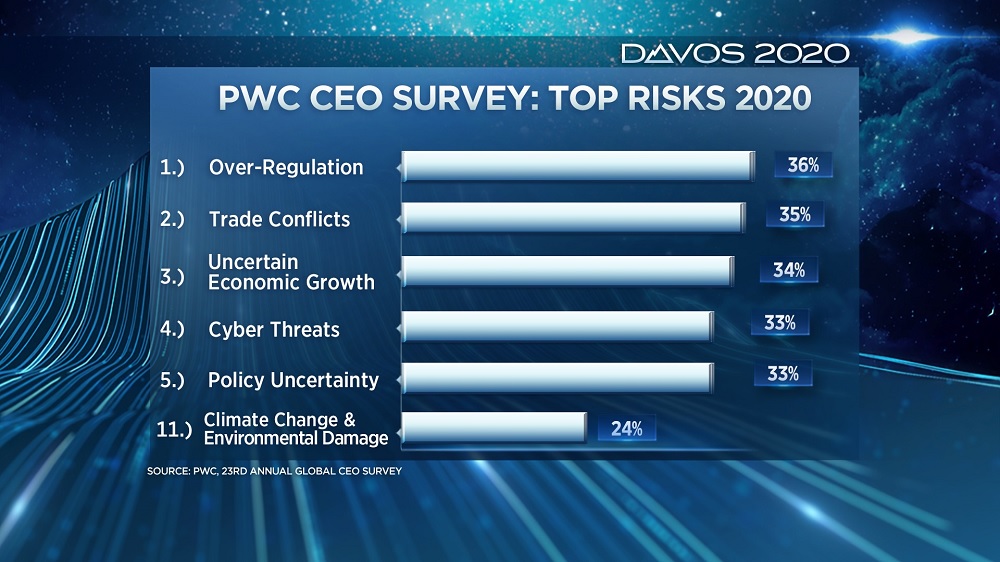

The survey by PwC showed that “climate change and environmental damage” were 11th in the rankings that CEOs gave as the biggest threats to their companies’ growth prospects. Their number one worry was overregulation.

Climate change and sustainable business will be a key focus for delegates at this year’s WEF summit, but other political risks such as international trade and geopolitical instability will top the agenda as well.

High-profile attendees this year include U.S. President Donald Trump and climate activist Greta Thunberg. Both are expected to take to the stage at WEF on Tuesday; Thunberg spoke on a panel at 7:30 a.m. London time and will give a keynote speech later in the day and Trump will deliver his keynote speech at around 10:30 a.m. London time.

However, the event itself has been criticized for putting climate change at the top of the agenda when environmental activists argue that many delegates arriving on private planes represent some of the worst climate offences.