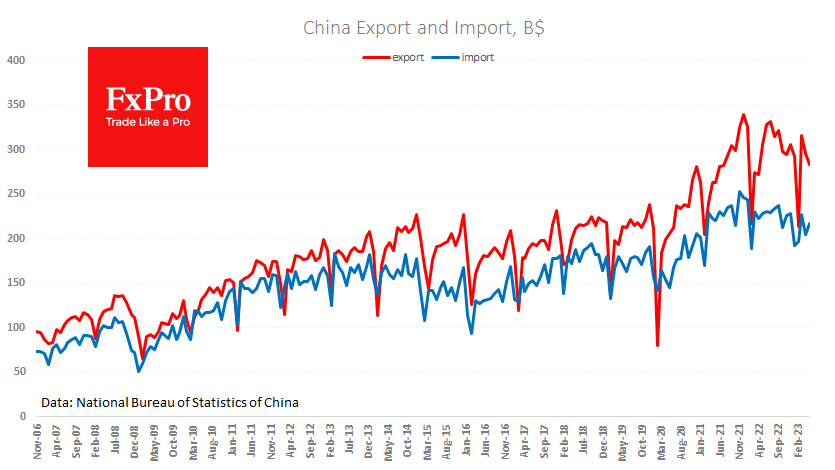

Further signs of a slowdown in China came from the trade balance. The foreign trade data published in the morning was noticeably weaker than expected.

Dollar-denominated exports fell by 7.5% YoY despite a more than 4.5% weakening of the Chinese yuan against the dollar during this time.

Imports fell by 4.5% y/y, declining against the previous year for nine of the last ten months.

The trade surplus narrowed in May to $65.8bn against expectations of $95bn, a sharp dip instead of an uptrend.

After this report, it is unsurprising that the People’s Bank of China had urged state banks to lower interest rates to stimulate domestic demand earlier in the day. Given the shallow inflation (starkly contrasting to most of the world), there is still plenty of room for stimulus.

A separate trend is the renminbi, which has been retreating methodically against the dollar for the last eight weeks, roughly following the trend of last year and leaving the renminbi 7% below levels from a year ago.

If the authorities maintain the gradual weakening of their currency, this could support the competitiveness of Chinese exports. However, if no improvement in export dynamics is visible, further pressure on the renminbi should be expected. If the PBC tries to maintain a 7% weakening of the renminbi against the level of a year earlier, the USDCNH could rise to 7.8 in October.

The FxPro Analyst Team