China has unveiled stimulus measures to boost the economy. The scale is not impressive – it is not an all-out crisis salvo but rather an attempt to stop a slide here and there. The People’s Bank of China announced a 0.2 percentage point cut in benchmark interest rates and a 0.25-0.50 percentage point cut in the reserve requirement ratio, freeing up 1 trillion yuan ($142 billion) and easing the burden of mortgage payments.

Financial markets welcomed the move, which was larger than expected. The Hang Seng Index rose 4% on Tuesday, taking the rally from September lows to 13%. However, unlike the S&P500, which has stormed to all-time highs, this is only a four-month high and about 42% below the 2018 peak. China’s blue-chip index is about the same distance from its highs, highlighting the impact of trade wars on the country’s financial market.

The opposite is true for bonds, where low interest rates and chronically low inflation have led to historically low government bond yields, meaning their prices have risen.

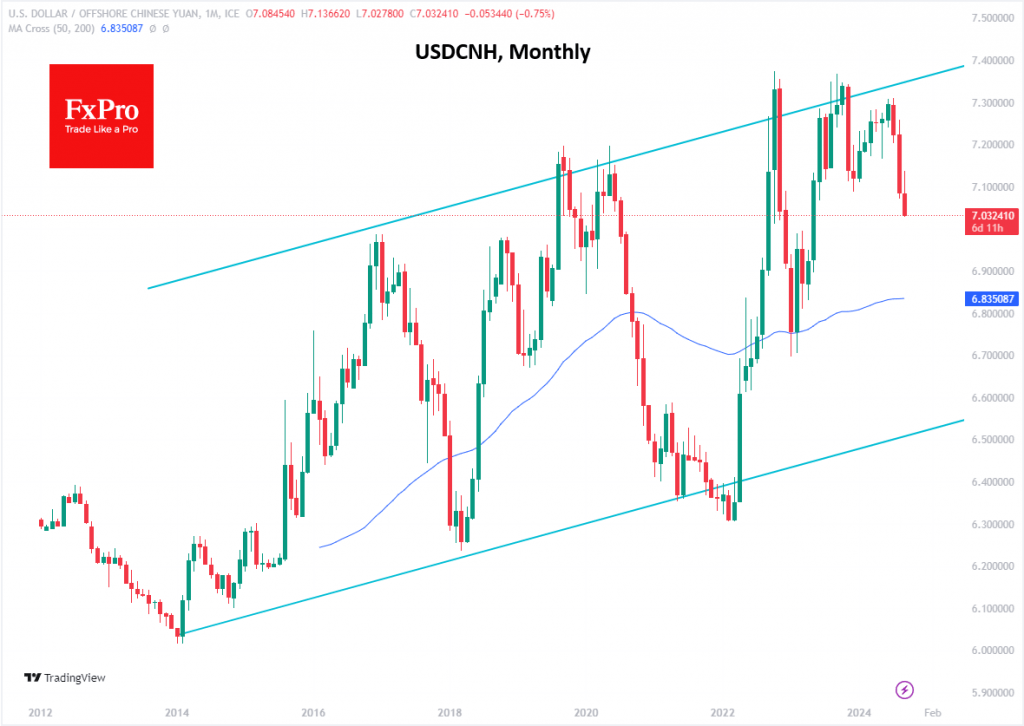

The yuan has gained 3.7% against the dollar over the past three months, not much by forex standards but impressive for the USDCNH. The pair has pulled back to 7.03, the low since May 2023, and has reversed from the area of long-term highs at 7.30.

The strengthening of the yuan is an interesting market reaction, suggesting capital inflows from external markets. It won’t help competitiveness, but it could boost economic activity through investment.

In our view, despite the rate cut, the yuan could strengthen further, possibly towards the cyclical support level around 6.50.

The announced stimulus could bring some capital back into Chinese markets, especially if the Politburo sees an opportunity to support the economy and the struggling construction industry.

The FxPro Analyst Team