China’s economic growth is falling short of economists’ expectations, putting pressure on the yuan and raising questions about the sustainability of the national and global economies.

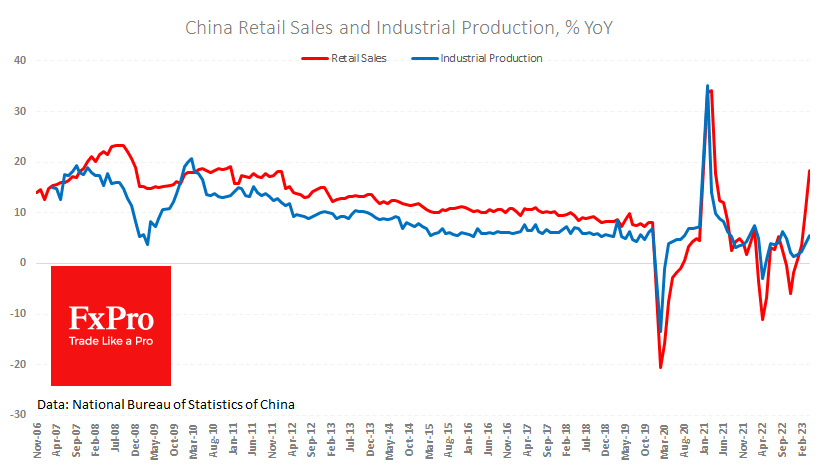

Industrial production rose 5.6% y/y in April, but the average forecast was 10.9% y/y due to low base effects. Retail sales growth also missed expectations, reaching 18.4% y/y versus the expected 22%.

Disappointing data is more a manifestation of economic inertia than a sign of weakness. Assuming that the problem is simply one of the inflated market expectations, the situation in China looks much better than in most developed countries. The unemployment rate has fallen to its lowest level since November 2021, which bodes well for the coming months. With jobs, people are spending more, so the outlook for the coming months is less bleak.

The weaker-than-expected data put pressure on the renminbi. The USDCNH briefly touched 6.978, a high of 6.978 this morning, and is now approaching a test of the psychologically important 7.0 level, which the pair has failed to break since last December. A break above this level could be an important milestone for the forex market, adding to the general pressure on the renminbi and risk assets.

The FxPro Analyst Team