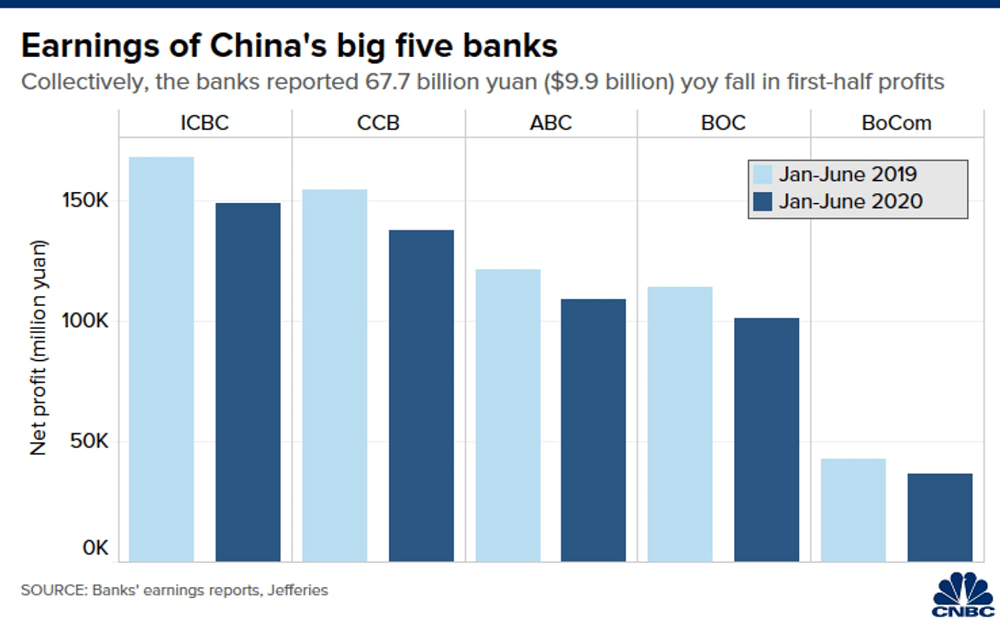

China’s five largest banks reported their biggest profit declines in at least a decade as they brace for further increases in bad loans in an economy weakened by the coronavirus pandemic. The five lenders — Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China and Bank of Communications — released their latest financial report cards last week.

All five posted at least 10% year-on-year declines in profit for the first half of 2020 as they set aside more funds for potential loan losses in the coming months — much like many banks around the world.

Chinese banks, among the world’s largest by assets, have been placed at the front line of the government’s effort to soften the economic blow on households and businesses. Authorities in Beijing reportedly asked financial institutions to sacrifice 1.5 trillion yuan ($219 billion) in profits this year to help companies by lowering lending rates and deferring repayments on loans.

The Chinese economy — the world’s second largest — is expected to grow just 1% this year as measures to contain the coronavirus hit global economic activity, according to the International Monetary Fund. That would be China’s weakest growth in at least 40 years, according to data by the fund.

China, the first country to be hit by the fast-spreading coronavirus, has shown some signs of economic recovery. But the effect of the economic slowdown on banks have not materialized fully, said Tan.

Shares of Chinese banks suffered in 2020. The FTSE China A 600 Banks Index — which tracks large- and mid-cap banks listed on mainland China exchanges — declining by around 8.9% so far this year, according to Refinitiv data. In contrast, the broader FTSE China A 600 Index has climbed by 17.9% during the same period, Refinitiv data showed.

China’s mega banks lost billions of dollars in profit as bad loans rise during coronavirus pandemic, CNBC, Aug 31