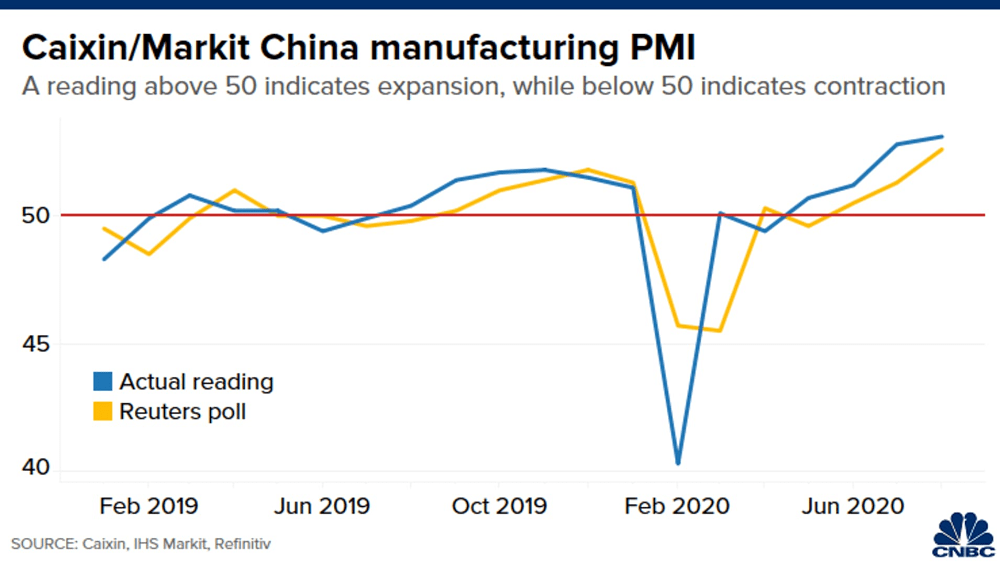

Results of a private survey on Tuesday showed China’s manufacturing activity expanded in August at the fastest pace in nearly a decade. The Caixin/Markit manufacturing Purchasing Managers’ Index (PMI) came in at 53.1 for August, compared to 52.8 in July. Economists polled by Reuters had expected Caixin/Markit manufacturing PMI to come in at 52.7.

PMI readings above 50 indicate expansion, while those below that level signal contraction. The readings are sequential and indicate on-month expansion or contraction. The expansion in August was the fastest since January 2011, Caixin and IHS Markit said in their joint report.

China’s manufacturing sector has been battered as factories temporarily shut earlier this year due to large-scale lockdowns to contain the coronavirus pandemic. Global demand was also hit as the virus spread around the world. But recent data show signs of China’s economy recovering from the pandemic. On Monday, China’s National Bureau of Statistics reported that official manufacturing PMI for the month of August came in at 51.0, slightly missing analysts expectations for a 51.2 reading.

Strong investment into real estate and into infrastructure projects likely boosted manufacturing activity, said Helen Qiao, chief Greater China economist at Bank of America Securities. Consumer demand also seems to be swinging back as indicated by the expansion in export orders in August, she added.

The official PMI survey typically polls a large proportion of big businesses and state-owned companies. In comparison, the private Caixin and IHS Markit survey features a bigger mix of small- and medium-sized firms.

A private survey shows China’s manufacturing sector expanded in August at the fastest pace in nearly a decade, CNBC, Sep 01