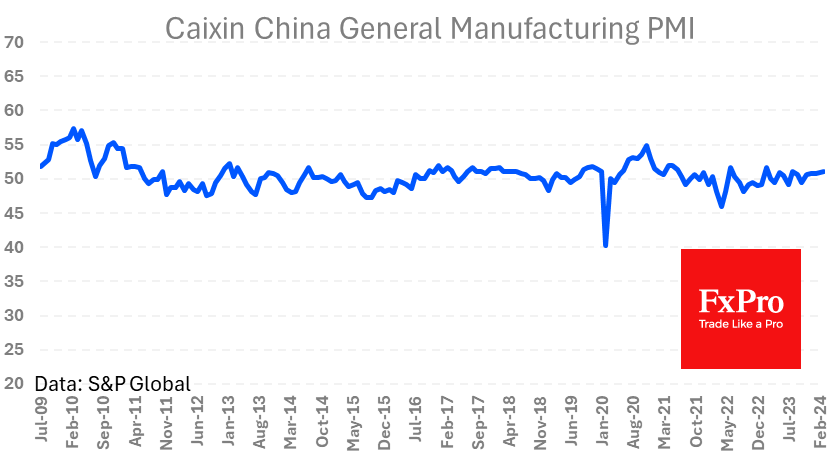

During a relatively quiet Monday trading session, the main trend was set by China’s manufacturing PMI data. The index came in at 51.1 for March, just above the expected 51.0 and the previous 50.9. On a positive note, this is the highest level of the index since February 2023, suggesting a continued recovery in manufacturing activity. Manufacturing accounts for around 30% of China’s GDP, compared with around 10% in the US and 18% in Germany.

The better-than-expected data, which confirmed the upward trend in activity, supported appetite for riskier assets. In the currency market, the positive data is helping to contain the pressure on the yuan that it came under a few weeks ago. It is also positive for commodity markets, where China’s consumption dynamics are an important source of volatility.

Later in the week, markets will also turn their attention to China’s services PMIs on Wednesday, but the focus will be on Friday’s US employment estimates for March.

The FxPro Analyst Team