Factories in China are turning to technology to tackle a pending labor shortage. Per official figures, the country’s working age population has shrunk by more than 5 million people in the last decade as births have dropped – despite a rollback of the controversial one-child policy. And for the factories that have driven much of modern China’s growth, workers are already in short supply, pushing wages up. That’s forcing companies to relocate or increase automation, especially as the labor shortage looks like it will only get worse.

Young people today aren’t willing to work on factory floors, said Shirley Zhou, IT director at Midea, a home appliance giant based in southern China. The company raked in 77.69 billion yuan ($11.95 billion) in operating revenue for the quarter ended September, up more than 15% from a year ago. While Midea can find enough workers for now, the company has embarked on a three-year plan to incorporate more technology into its 34 factories, beginning with seven this year, Zhou said. The goal is to double that number next year, and cover 25 factories in 2023, she said.

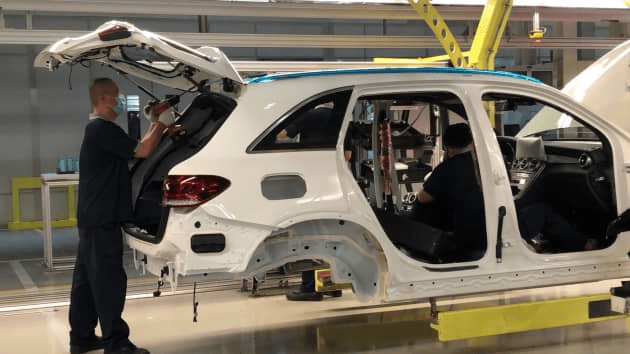

The company’s modeling predicts that automating manufacturing with sensors and robots will increase assembly efficiency across its factories by 15% to 20%. For two factories that have already integrated such tech, efficiency has increased by nearly 30%, Zhou said. Midea’s strategy marks just one of many technology upgrades that analysts say factories around the world are increasingly pursuing. Sometimes called “smart” or “intelligent” manufacturing, widespread use of new hardware and software in production is expected to ultimately boost efficiency as much as the Industrial Revolution did in the 18th and 19th centuries.

China’s factories automate as worker shortage looms, CNBC, Apr 9