An extensive package of statistics from China showed a much better economy than the average analysts had expected. But this set of economic surprises failed to affect the renminbi, which is falling for a second day, having lost 1.4% in the meantime.

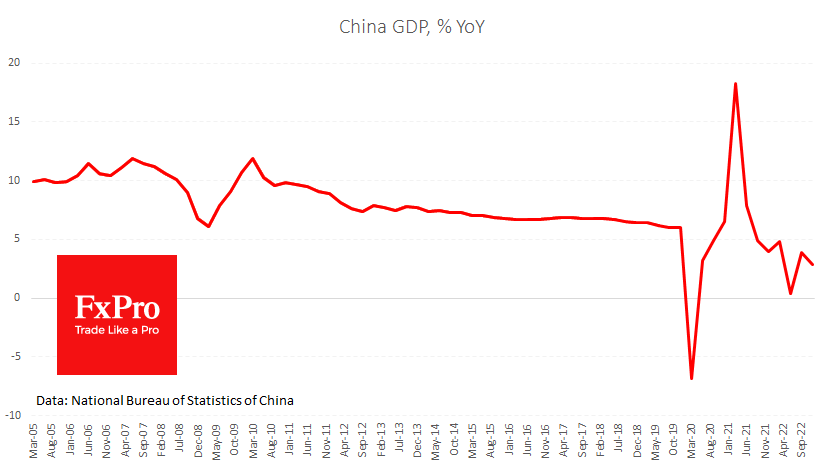

China’s economy grew by 3% last year (2.7% was expected). GDP was virtually unchanged for the fourth quarter, although a decline of 0.8% was expected, which is a considerable difference between expectation and fact.

The high-frequency data for retail trade and industrial production also exceeded expectations. The industrial production index in December was 1.3% higher than a year earlier. Since the start of the year, production has risen by 3.6%. Retail sales last month were 1.8% lower than a year earlier but were expected to fall by 9.5% y/y.

The unemployment rate fell from 5.7% to 5.5%, contrary to analysts’ forecasts that it would remain unchanged.

Often such a divergence triggers an impulse to buy currencies on the back of capital inflows into domestic assets. But this time, the markets have quietly digested the difference, developing a second day of a technical rebound in the renminbi after the 9% rally from the beginning of November to the peak at the end of last week.

So far, the movement of the last two days has resembled a “buy the rumour, sell the news” style technical bounce, as investors ramped up their investments in the yuan late last year, betting on a turnaround to greater openness.

And this bet is working on several fronts across a broad spectrum of activity, from abandoning the 0-covid policy to easing for the technology sector. On top of that, we are seeing a softening of rhetoric from trade representatives and a pumping of liquidity into the financial system. Simply put, China has comprehensively taken up economic growth stimulus to regain some of the appeal for investors that it has been losing in several waves since 2018.

The USDCNH exchange rate is consolidating near the 50- and 200-week averages after collapsing from 7.35 to 6.71 in just over two months. The exchange rate reduced near these same levels from May to August 2022 and found support in early 2019. Therefore, another potentially prolonged stop here is a probable scenario.

A market shakeout could lift USDCNH to 6.86-6.90 before we see a new reversal to the downside. At the same time, this would remove the short-term overbought yuan on FX and provide some impetus to the economy through exports.

If China supports the economy and opens up to investors in the coming weeks, capital inflows into the renminbi could continue. In that case, the USDCNH could return to 6.25-6.35, where multi-year lows and the 161.8% Fibonacci level from the last rally of the Chinese currency are concentrated.

The FxPro Analyst Team