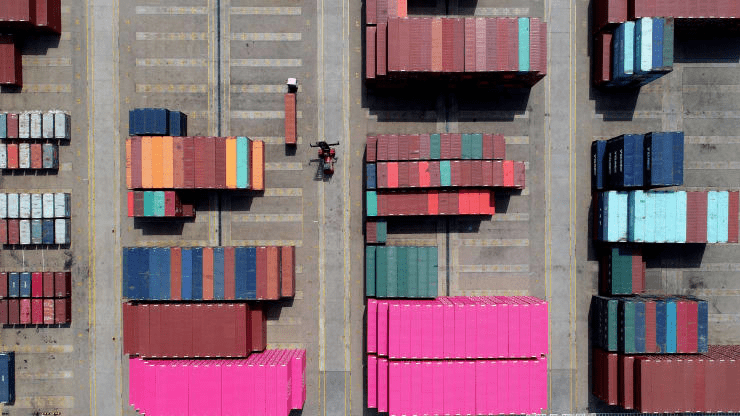

China’s dollar-denominated exports and imports rose in June, as restrictions eased and countries started to reopen their economies. The June customs data beat expectations of a decline, with exports posting a rise of 0.5% as compared with a year ago, and imports jumping 2.7% in the same period.

A Reuters poll had estimated that June exports contracted 1.5% from a year earlier, bouncing from a 3.3% decline in May. Imports were expected to fall 10.0% from last year, as compared with a drop of 16.7% in May, according to the poll. That could be attributed to higher purchases of crude oil and commodities.

Earlier, China published customs data that showed yuan-denominated exports in June rose 4.3% from a year ago, while imports jumped 6.2% in the same period. The jump in imports showed that China’s domestic demand remained strong, analysts said.

The June data also showed that China’s trade surplus with the U.S. widened to $29.41 billion, versus $27.89 billion in May, according to Reuters. Tensions between both countries have worsened this year, with U.S. President Donald Trump blaming China for the pandemic, and saying last week that he wasn’t even thinking about phase two of the trade deal.

Economies in Asia and the rest of the world have gradually started to reopen. Since mid-May, European countries and the U.S. have eased lockdowns, and that has led to increased shipments of some cargo backlogs previously stuck at Chinese ports, Reuters reported, citing the China Ports & Harbours Association.

However, the recovery is threatened by a resurgence of coronavirus, with cases climbing again in countries such as the U.S., Australia and South Korea. That has led to some restrictions being reinstated.

As the pandemic gripped the world, China’s exports in medical supplies jumped in the first half of the year

Exports of personal protective equipment jumped 32.4%

Exports of drugs were up 23.6%

Exports of medical equipment increased 46.4%

China says its dollar-denominated exports, imports jumped in June, beating expectations of a decline, CNBC, Jul 14