Global stock markets are starting the week with a bang after China’s influential state media stoked bullish enthusiasm. The dollar index fell for a fifth day and Treasuries dipped.

Banks, construction and insurance shares pushed the Stoxx Europe 600 Index higher, and U.K. homebuilders rallied after a report that the government is considering a temporary increase in the threshold at which buyers pay stamp duty. Copper is on the cusp of erasing this year’s losses after virus-related disruptions tightened supplies.

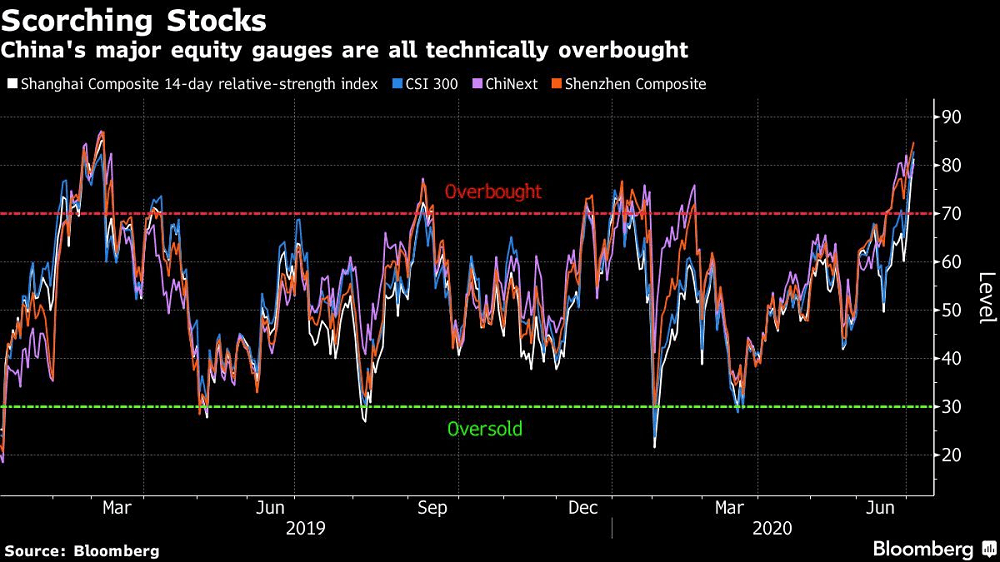

A front-page editorial in China’s Securities Times on Monday said that fostering a “healthy” bull market after the pandemic is now more important to the economy than ever. Chinese social media exploded with searches for the term “open a stock account,” with bullish sentiment also lifting the yuan. The Shanghai Composite Index closed up 5.7%, the biggest advance since 2015.

The MSCI World Index is now at the highest level since early June, with investors putting their faith in an economic recovery powered by historic government stimulus.

Futures on the S&P 500 Index increased 1.1% as of 10:18 a.m. London time.The Stoxx Europe 600 Index gained 1.2%.The MSCI Asia Pacific Index increased 1.7%.The MSCI Emerging Market Index climbed 1.8%.

The Bloomberg Dollar Spot Index fell 0.3%.The euro advanced 0.3% to $1.1284.The British pound gained 0.1% to $1.2497.The Japanese yen was little changed at 107.55 per dollar.

West Texas Intermediate crude gained 1.2% to $40.79 a barrel.Gold strengthened 0.3% to $1,777.31 an ounce.LME copper gained 1.3% to $6,095 per metric ton.

China Propels Global Stock Rally to One-Month High, Bloomberg, Jul 6