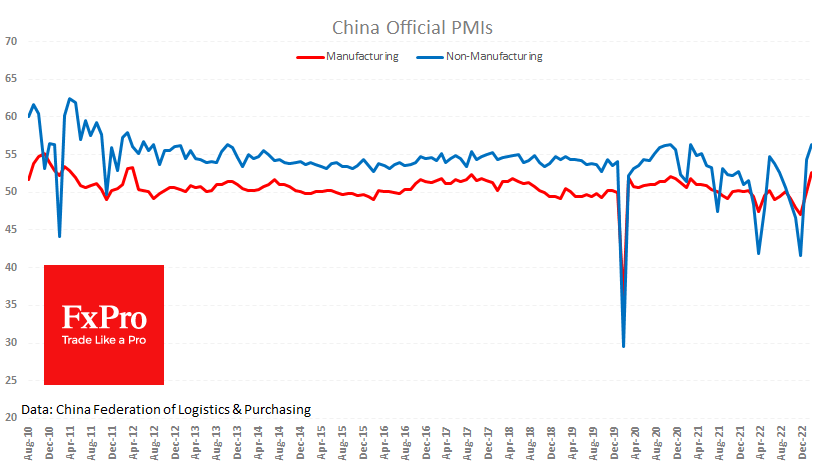

Lifting the lockdown and the end of the Lunar New Year celebrations led to a strong rebound in Chinese economic activity. The manufacturing PMI jumped to 52.6 in February from 50.1 the previous month, according to an official release from the CFLP. MarkIt’s manufacturing PMI (which conducts similar surveys worldwide) rose from 49.2 to 51.6 last month.

In both cases, we see a move from stagnation or a slight contraction to a growth rate that the official report has not seen since 2017. This can easily be explained by a low base, as the survey assesses the dynamics of the reporting month compared to the previous month.

The acceleration in the services sector is also impressive. The non-manufacturing PMI jumped to 56.3 in February, up from 54.4 in January. Growth in the services sector was the fastest since March 2021.

While China’s main challenge will be maintaining this growth rate, such a sharp turnaround surprised economists. They had expected a much smoother return to growth.

Markets have also underestimated China’s ‘vibrant’ reopening, with the renminbi up 1.4% against the dollar today, its strongest since late November.

The rise in the Yuan is important from a technical point of view, as it sets the USDCNH up for further declines. The pair’s rally in February from 6.70 to 6.99 appears to have been a corrective bounce from the October high of 7.35. Since the beginning of this week, the pair has fallen from the 61.8% Fibonacci retracement level and failed to reach the psychologically important 7.0 level, where it had a prolonged consolidation in December.

A complete realisation of the above formation implies that USDCNH would fall to 6.28-6.30. This is the crucial area of the cyclical lows of February last year and April 2018. In both cases, the USD/Yuan reversed to the upside on the back of cooling rhetoric from the US and European authorities towards China and an impressive revision of the country’s economic outlook. It would be premature to bet on a return of the renminbi to those heights. A return to 6.7, where the pair was a month ago, may be challenging for the renminbi bulls.

However, the 200 SMA indicates that it could change its trend, as we could see an abrupt move below this line today, which would be a strong sign that the USD buyers will capitulate from this critical level that the big banks are looking for. The Yuan is working very dutifully through the 200 SMA. Consolidation below 6.9 today (now 6.86) could repeat the situation in mid-2020 when such a breakout was a prologue for a big dip.

There is also a counterexample from February 2019, when a break of this support line led to a horizontal consolidation but not the trend reverse. Macroeconomic data and some dollar weakness in recent days suggest that the renminbi will continue to strengthen in the coming weeks and test 6.7 by the end of March, leaving the potential for a move lower.

The FxPro Analyst Team