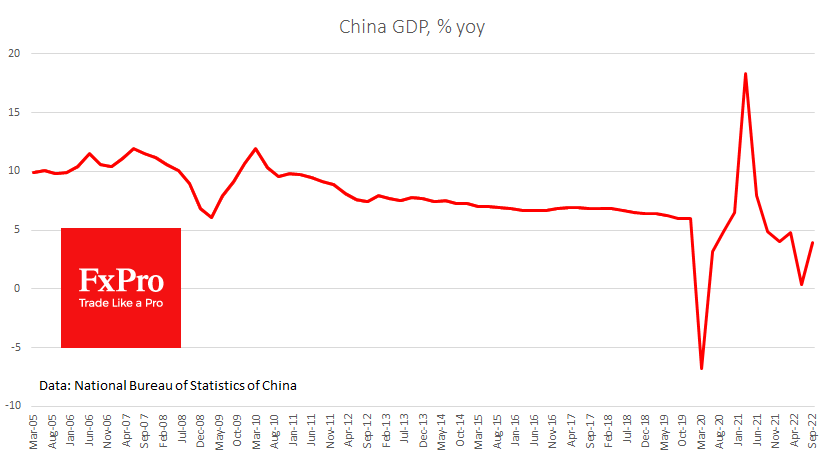

After a delay related to the Communist Party congress, China published a batch of monthly and quarterly statistics, which caused mainly disappointing reactions from analysts.

GDP added 3.9% in the third quarter compared to a year earlier against expectations of 3.5%. In the three quarters, the economy added 3.0% over the same period a year ago against 2.5%, the first-rate increase in more than a year.

Also among the positive signals was a jump in industrial production by 6.3% y/y in September compared to 4.2% the month before and the expected 4.9%.

A trade surplus is also higher than expected, but an essential reason for its growth was a fall in imports rather than increased exports, which is not good macroeconomic news.

A very alarming signal was the cooling of retail sales from 5.4% to 2.5% (3.1% expected). Chinese government officials declare a further commitment to a zero covid expansion policy, potentially preventing economic activity from getting firmly back on the growth track.

An additional worrying factor for Asian markets is the reappointment of Xi Jinping for a third term. Investors are selling off Chinese assets on this news, suggesting a further course of austerity in the country, escalating tensions around Taiwan and anti-market reforms.

Contrary to the famous adage, markets have not been “selling the fact” of Xi’s unprecedented third term, for which they have been preparing in recent months. The Chinese yuan has rewritten lows against the dollar since 2008, and the offshore USDCNH exchange rate has surpassed 7.30. Key Chinese stock indexes are losing about 7% on Monday, pushing the Hang Seng index to lows since 2009 and the China H-share to 2005.

The FxPro Analyst Team