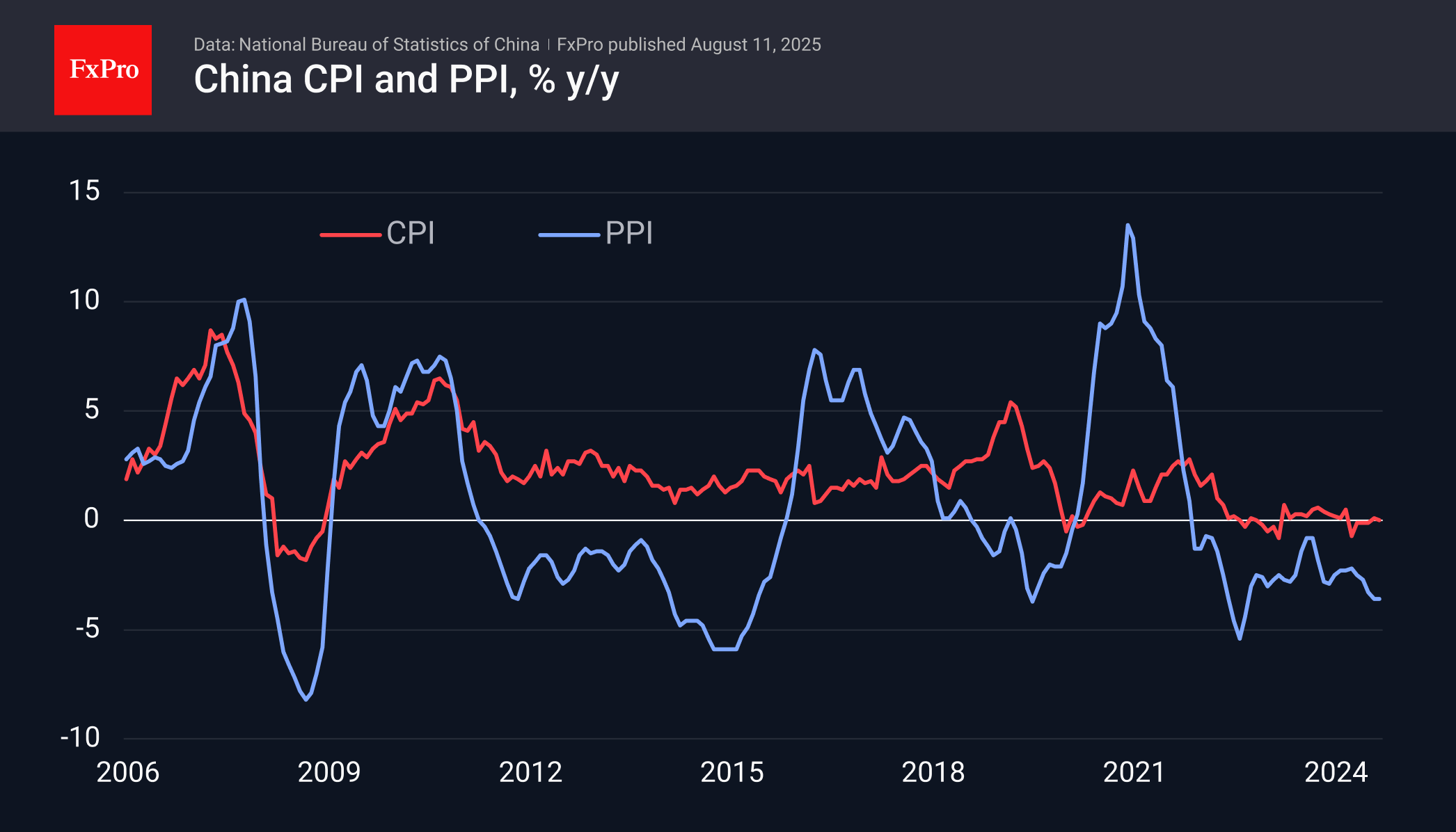

China remains a net exporter of deflation, with producer prices falling for the last 34 consecutive months. Subdued economic growth results in this, which leaves room for further stimulus measures, potentially positive for the stock market but negative for the yuan exchange rate.

Consumer inflation was 0.0% y/y in July and has remained virtually unchanged over the past two years. When prices do not rise, people have no incentive to spend money “today”, suppressing GDP, so governments mandate central banks to target positive inflation.

Producer prices in China fell at a rate of 3.6% y/y in July. In July 2024, a decline of 0.8% was recorded, and in July 2023, it was -4.4%. The annual rate of decline has accelerated in the last year, a clear sign of the slowdown in global growth, which has caused a decline in commodity and energy prices. In addition, US tariffs are reducing demand for Chinese goods, exacerbating domestic deflationary trends.

A visible acceleration in US and Chinese growth rates will be needed to reverse this trend, and the first step in this direction could be a reduction in the Fed’s key rate, but a more rapid effect could be achieved by easing the tariff regime.

The FxPro Analyst Team