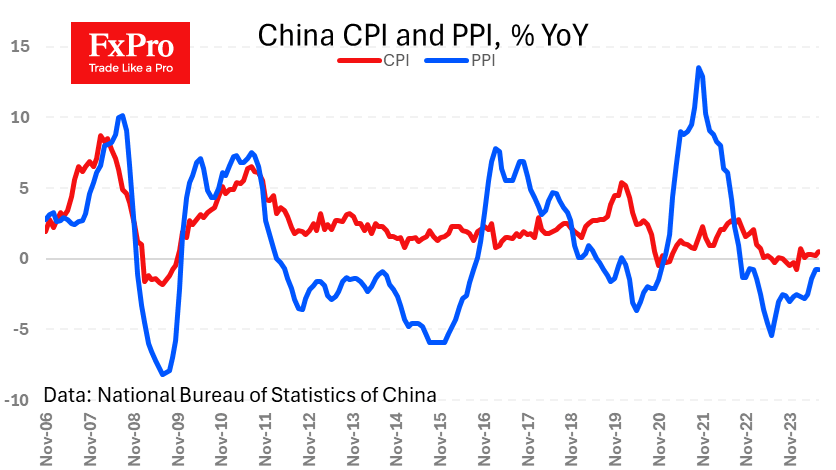

China’s consumer inflation accelerated to 0.5% y/y in July from 0.2% in the previous month. This is well above the expected 0.3% and reduces the risk of deflation taking hold. At the same time, producer prices fell by 0.8% y/y for the second month. This is a continuation of the recovery in relative terms (-0.8% y/y vs -5.4% y/y in June 2023), but in absolute terms, it is a further fall in prices.

In this case, the rule that no bad news is good news may well apply. In general, higher inflation figures are positive for the currency as they suggest a tighter monetary policy path in the medium term.

From this perspective, the Chinese yuan had a textbook reaction on Friday, regaining its gains against the dollar. However, yuan traders should keep in mind that the Chinese currency is actively used as a funding currency in the interest rate differential game. This means that the USDCNH is directly correlated to equity indices.

This strategy is attractive during periods of low volatility, which has been the case since April last year. However, three bouts of volatility (in October, April, and earlier this week) can wipe out all the gains. The big question is whether the unwinding of the carry trade is over.

The FxPro Analyst Team