Weak Swiss inflation renewed the downward momentum of the franc, which is losing over 0.5% against the euro, sending EURCHF to highs last seen in May 2023.

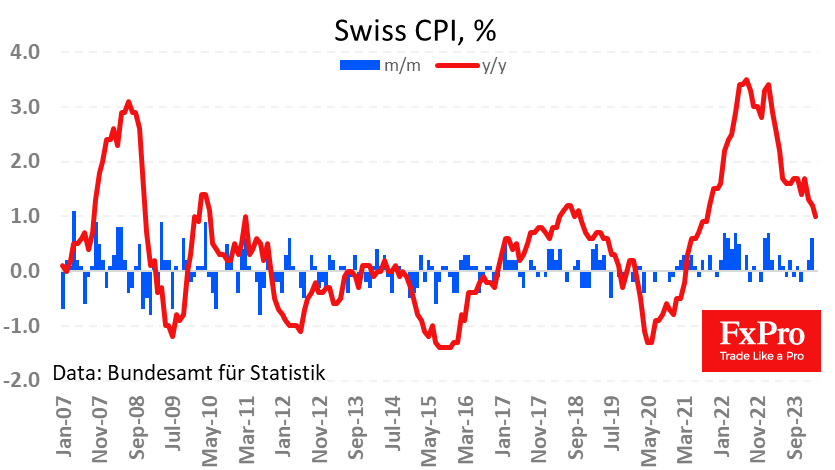

The Swiss Consumer Price Index was virtually unchanged for March, with annual inflation slowing to just 1.0% – the lowest since September 2021. The Swiss National Bank has already unofficially celebrated a victory over inflation by unexpectedly cutting rates last month.

Fresh inflation data reinforces expectations of further policy easing. The franc has fallen for the past nine consecutive weeks, losing over 6% against the euro from extremes late last year. This is a significant move for a low-volatility pair like EURCHF, which has already returned to levels at the start of 2023. A further fall in the franc against the euro would work to inflate inflation, which is unlikely to please the SNB.

On balance, this means that the inertial upward movement in EURCHF could continue in the coming days or weeks, bringing the pair closer to parity. However, a subsequent depreciation of the franc against the euro or dollar has the potential to force the SNB to reconsider the soft approach. This is well within their power, as this CB is very active in forex and has room for policy tightening.

The FxPro Analyst Team