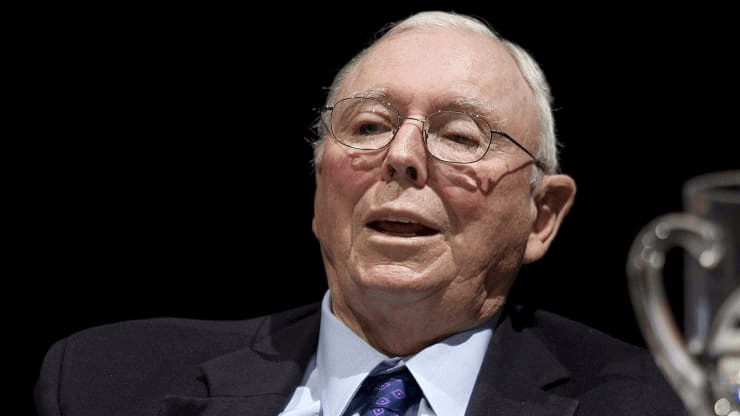

Charlie Munger, vice chairman of Berkshire Hathaway and Warren Buffett’s longtime business partner, on Wednesday dismissed the rocketing share price of Tesla and the recent bitcoin frenzy. During an interview at the Daily Journal’s annual shareholder’s meeting, Munger was asked whether he thought it was crazier for bitcoin to hit $50,000 or for Tesla to reach a $1 trillion fully diluted enterprise value, he said: “Well I have the same difficulty that Samuel Johnson once had when he got a similar question, he said, ‘I can’t decide the order of precedency between a flea and a louse,’ and I feel the same way about those choices. I don’t know which is worse.”

Shares of Tesla rocketed 743% last year, though it’s currently down about 3% for 2021. Its market cap is about $689 billion. Bitcoin continued to surge to more than $50,000 over the past week after Tesla announced it bought $1.5 billion worth of the cryptocurrency.

Munger was also asked what the biggest threat to banking is, and whether it was bitcoin or digital wallets like Apple Pay and Square. “I don’t think I know what the future of banking is, and I don’t think I know how the payment system will evolve,” he said. “I do think that a properly run bank is a great contributor to civilization and that the central banks of the world like controlling their own banking system and their own money supplies.” “So I don’t think bitcoin is going to end up the medium of exchange for the world. It’s too volatile to serve well as a medium of exchange. And it’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any bitcoin.”

Charlie Munger doesn’t know what’s worse: Tesla at $1 trillion or bitcoin at $50,000, CNBC, Feb 25