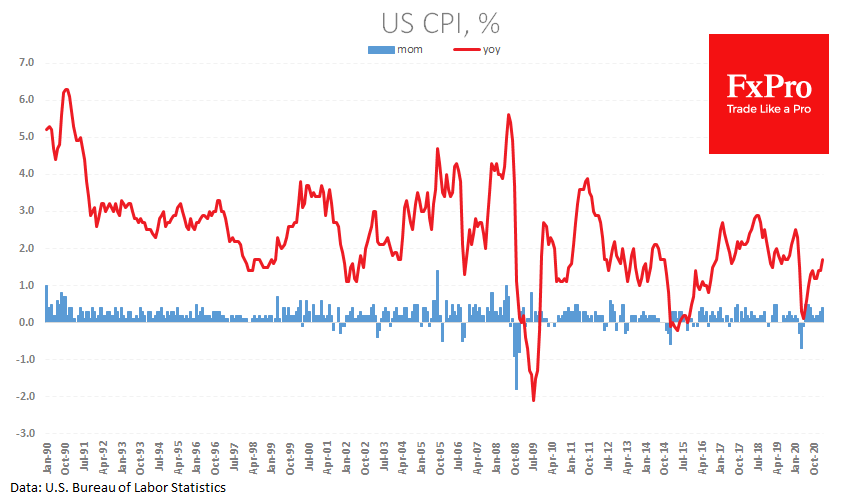

US Consumer prices rose by 0.4% over February, and by 1.7% y/y, after 1.4% in January. The data was in line with expectations but barely relieves the main fear of the markets of price rises acceleration. Food and energy prices are pulling the index up, and clothing, healthcare products and services (ex-energy) dragging down.

Accelerating price growth at low rates undermines the dollar’s value, taking real bond yields deep into negative territory. But this is a policy pursued by many central banks, so the effect is only seen in the prices of exchange-traded assets and commodities.

The lasting effect on the dollar may come from the policy divergence with other central banks. In the early 2000s, the Fed kept the interest rate lower for longer compared to others, which caused a multi-year pressure on USD. In contrast, after the global financial crisis, the Fed was the first to mark a U-turn towards policy normalisation, which predetermined the upward USD trend in 2014-2016.

The FxPro Analyst Team