- Central banks prefer to pause.

- The strengthening of the dollar prevented gold from reaching a record high.

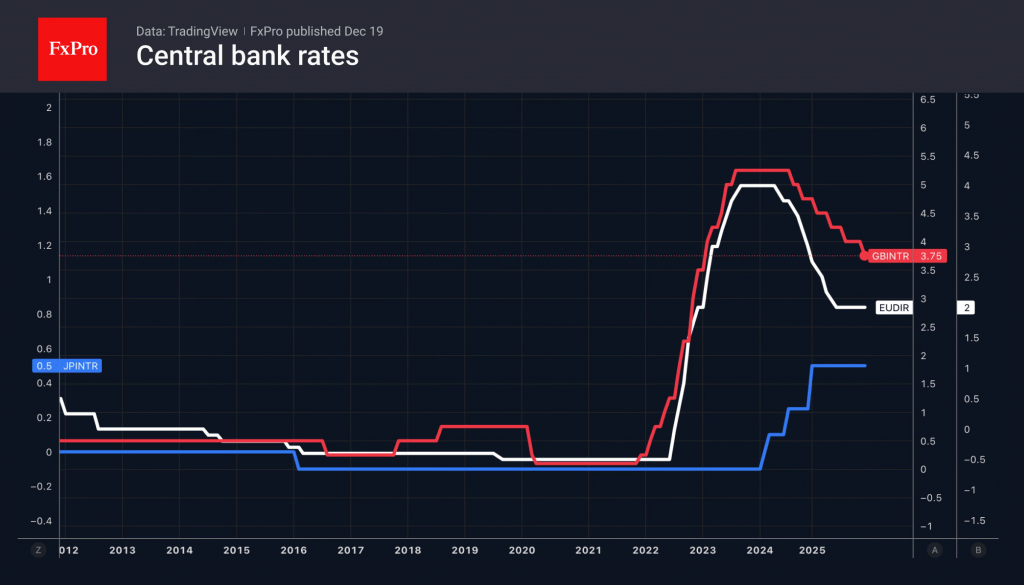

Global central banks are diverging in their policy paths. In the wake of the Fed’s decision, Britain and Mexico have lowered rates, whereas the eurozone, Norway, and Sweden have signalled a continued pause. The Bank of Japan tightened its policy, raising the overnight rate to its highest level since 1995 at 0.75%. Nevertheless, the US dollar strengthened against major world currencies on expectations of a prolonged pause in the process of lowering the federal funds rate.

The Bank of England lowered the repo rate to 3.75% by five votes to four. Andrew Bailey warned of limited room for manoeuvre in the monetary expansion cycle in 2026. As a result, the futures market reduced its expected scale to 25 basis points. The pound initially strengthened, but a reassessment of US inflation data brought GBPUSD back down to earth.

As expected, the ECB raised its eurozone GDP forecasts to 1.4% in 2025 and 1.2% in 2026. The central bank expects inflation to remain below target until 2028. Christine Lagarde did not encourage the ‘hawks’ who had previously discussed raising deposit rates. The Frenchwoman repeated the mantra that the European Central Bank is in a comfortable position. The EURUSD’s inability to break through resistance at 1.176 resulted in a sell-off.

The Bank of Japan raised its overnight rate to 0.75%. This outcome of the December meeting was predicted by all 50 Bloomberg experts. In this regard, after the BoJ’s verdict, a sell-off of the yen began on the facts. Moreover, the Governing Council did not signal a continuation of the cycle of monetary tightening.

The US dollar strengthened against major world currencies as investors ignored the slowdown in US core inflation to 2.6% in November. This is the lowest level since the beginning of 2021. After the shutdown, the BLS is experiencing problems with data. It will take time for confidence in it to return.

The market’s reluctance to take US consumer price statistics at face value played a cruel joke on gold. The precious metal hit a new local high but failed to reach a record high and was forced to retreat due to the strengthening of the US dollar. According to Goldman Sachs, structurally high demand from central banks for bullion and cyclical support from the Fed’s rate cuts will continue to create tailwinds for XAUUSD.

The FxPro Analyst Team