- Increased risk appetite divides G10 currencies

- The US and Canada intend to lower rates.

- The ECB and BoJ have opted for a wait-and-see approach.

- Japan may resume interventions.

Markets started the last week of October on a positive note. Rumours of a trade deal between the US and China boosted global risk appetite. Safe-haven assets such as the yen and the franc came under pressure. In contrast, the yuan’s proxy currencies, the Australian and New Zealand dollars, performed better. Beijing is signalling a settlement of issues related to export controls, fentanyl and shipping fees. Washington claims that 100% tariffs are off the table and that China will increase its purchases of American soybeans.

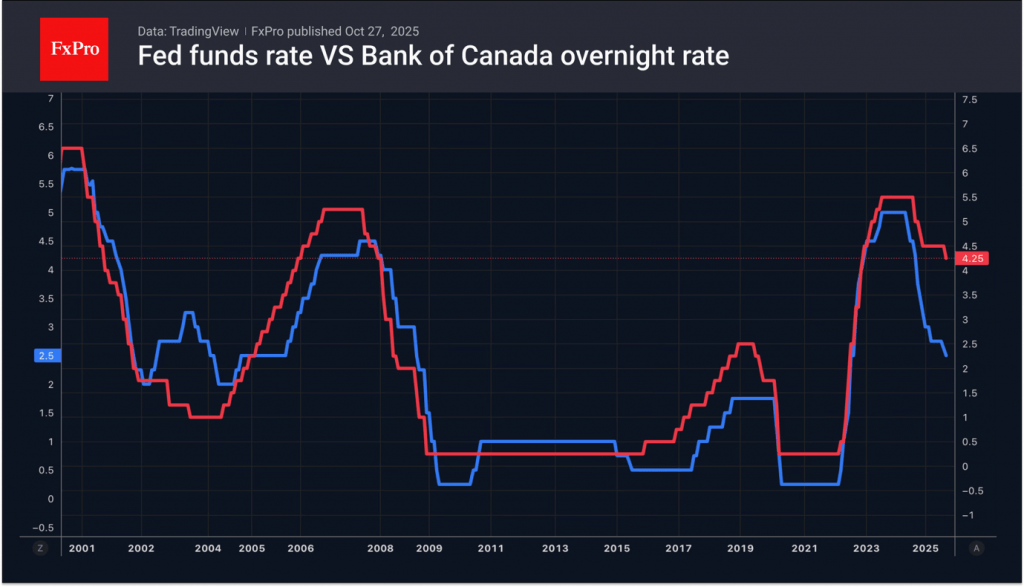

Investors will focus on central bank meetings and Donald Trump’s tour of Asian countries. Monetary policy works on a geographical basis. North America intends to lower rates, while Europe and Asia plan to keep them steady. Concerns about a cooling labour market allow the futures market to predict a reduction in the Fed’s rate from 4.25% to 4% and the Bank of Canada’s rate from 2.5% to 2%.

The Bank of Japan is unlikely to tighten monetary policy amid the change of prime minister. Sanae Takaichi and her team believe the government and the central bank should act in unison. Coupled with improved global risk appetite, this puts pressure on the yen. However, Donald Trump intends to visit Tokyo. Given the US president’s reluctance to strengthen the dollar, his visit may fuel rumours of currency intervention and slow down USDJPY.

The ECB is expected to signal the end of its policy easing cycle. According to most Bloomberg experts, the deposit rate will remain at 2% until 2027. 17% of respondents predict an increase in 2026. Divergence in monetary policy is supporting EURUSD. However, the pair is not rushing to grow. Bulls fear hawkish rhetoric from the Fed after the federal funds rate cut.

In addition, the political drama in France is not over yet. Encouraged by the postponement of pension reform, the Socialists are demanding new concessions and intend to pass a law to increase taxes on the rich. As a result, the yield spread between local and German bonds has started to widen again, reflecting increased political risks, which is putting pressure on the euro.

The FxPro Analyst Team