The armed conflict in Ukraine continues to have a destabilizing effect on the markets. With no visible signs of de-escalation over the weekend, markets opened the week with impressive gaps. They continued to move in the directions that were set back in February.

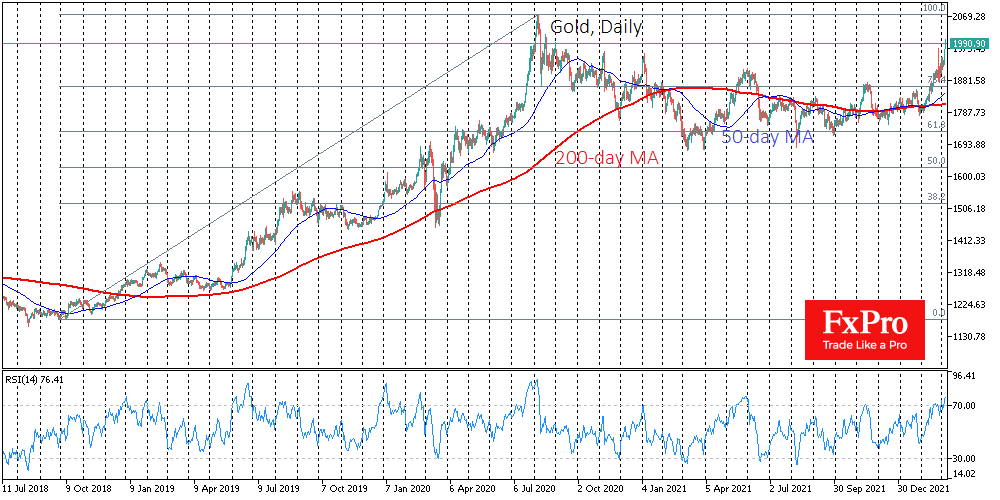

By the beginning of active trading in Asia, an ounce of gold has reached $2,000, then retreating to $1,990. Above the current values, the precious metal was traded only for a short time in early August. The craving for gold has intensified amid growing signs that the crypto exchanges and platforms are supporting sanctions against Russia, blocking Russian wallets from the sanctions lists (and thousands allegedly associated with them), and prohibiting Russian residents from opening wallets the largest exchanges. All that leaves no choice to investors by directing their capital to gold as the primary haven.

Over the weekend, the US considered a ban on oil imports from Russia. There were hints that the United States could be followed by several countries for which such sanctions would not lead to irreparable consequences for the economy. The prospect of worsening oil supplies in the short term caused a 10% jump in the price of Brent this morning, which reached $129 on the spot market, and WTI – up to $125. The struggle for the energy resources remaining on the market has intensified among traders. Many operators avoid chartering oil from Russia and even Kazakhstan, fearing restrictions on bank transfers and fearing a tightening of the import ban in the coming days.

Futures for wheat and corn again rested against the allowable upper daily limits immediately at the opening of trading. To alleviate the humanitarian catastrophe at home, Ukraine limits the export of certain types of food products from obtaining special licences for meat and sunflower oil to a complete ban on such as buckwheat and sugar.

Risk aversion is also developing in the stock markets. The German DAX shed about 4% on Friday and started trading with another 3.8% on Monday. The main Asian indexes lose about 3-4% as the exit of world business from Russia and the jump in commodities and energy prices make the economic prospects sharply reassessed.

Capital is fleeing Europe, which is also evident in the persistent sell-off of the euro and the British pound. EURUSD is trading below 1.09 to 22-month lows. EUR fell below the parity with CHF at the start of the trading on Monday. GBPUSD is near December minimums at 1.3200. A dip below 1.3160 would set the quote to the lowest levels since the end of 2020.

The market situation now more and more resembles a domino effect. Once in a zone of turbulence, assets can go much further uncontrollably before the situation stabilizes. The experience of the last 20 years shows that only powerful interventions from the government and central banks can stop the domino effect. Now this will also require the political will of the warring parties.

The FxPro Analyst Team