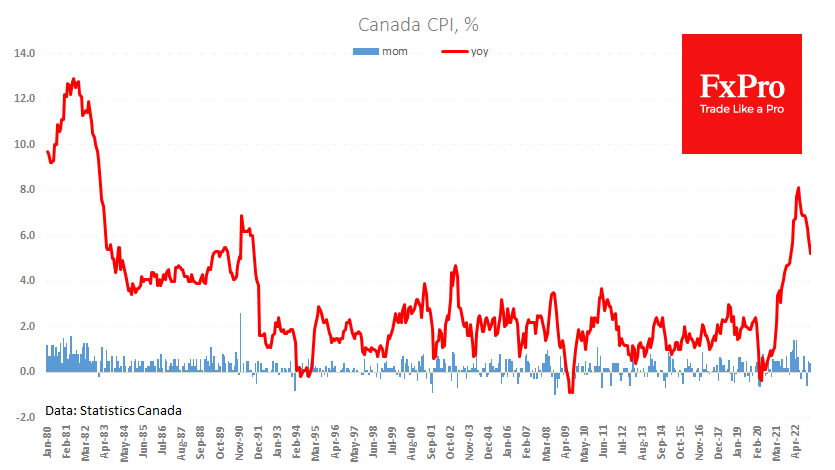

Canadian consumer prices rose 0.4% in February, with annual inflation slowing to 5.2% from 5.9%. Both figures were below expectations of 0.5% and 5.4%, respectively, reflecting a faster return to normality than economists had expected.

Consumer inflation excluding fuel and food, slowed to 4.7% year-on-year, the lowest since January last year, although the monthly increase was 0.5%.

The slowdown in the annual inflation rate can be explained by a high base effect, as prices rose by 1% per month in the first half of 2022. However, to avoid falling into the trap of an imaginary improvement, it is better to look at the monthly rate of increase.

It remained above the 0.17% needed in February to reach an annual inflation rate of 2%. Thus, inflationary pressures in Canada remain elevated, requiring the regulator to maintain a tight monetary policy stance.

In response to the weaker-than-expected figures, the USDCAD jumped ten pips but quickly pared the gains as high monthly price growth rates do not allow the Bank of Canada to consider its job done.

EaEarlier this month, the USDCAD peaked at 1.3860 after the Bank of Canada kept rates and fears that the Fed would double its rate hike pace. However, since the 10th of March, the pair has been in a steady decline as the divergence in expected policy rates has diminished. It will not be surprising if the Fed turns out to be more accommodative than the Bank of Canada, in line with the historical pattern. The pair’s decline promises to continue in that case, with a potential medium-term target near 1.33.

The FxPro Analyst Team