Canadian producer prices rose more than expected in July, reviving concerns that the active phase of the fight against inflation may not be over.

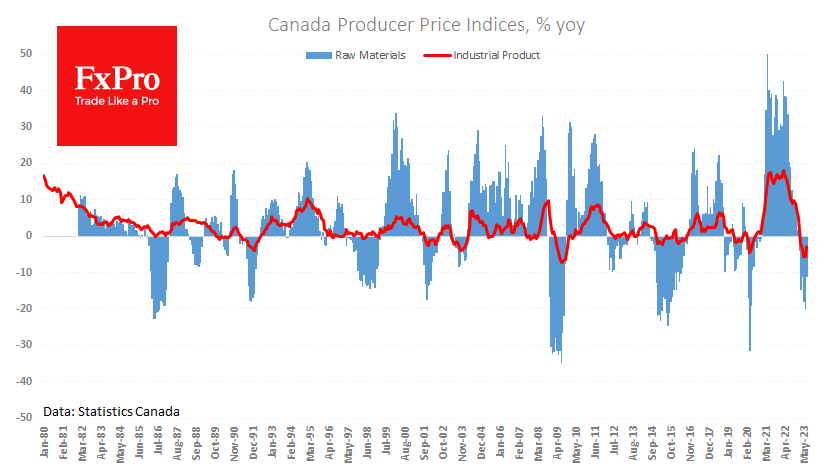

The Producer Price Index rose 0.4% in July, more than the 0.2% expected. The year-on-year decline slowed from 5.5% to 2.7%. The raw materials price index surprised even more, rising 3.5% m/m versus 2.1% expected. The annual rate of decline fell from 20.2% to 11.1%.

The deflationary impact of the commodity price correction in Canada is fading faster than expected. And this could be a trend for the US as well.

The USDCAD has gained 2.8% since the beginning of August, gaining on all but one day. This has returned the pair above 1.3650, its highest level since early June. The pair’s five-week rally has created a short-term overbought bias, but the longer-term trend remains bullish.

The FxPro Analyst Team